(Reuters) – U.S. commerce officers are anticipated to announce on Friday a brand new spherical of tariffs on photo voltaic panel imports from 4 Southeast Asian nations after American producers complained that corporations there are flooding the market with unfairly low cost items.

It’s the second of two preliminary choices that President Joe Biden’s Commerce Division is making this yr in a commerce case introduced by Korea’s Hanwha Qcells, Arizona-based First Photo voltaic Inc (NASDAQ:) and several other smaller producers in search of to guard billions of {dollars} in investments in U.S. photo voltaic manufacturing.

That is the newest chapter in a greater than decade-long commerce battle with Chinese language corporations over their photo voltaic dominance. Chinese language producers have responded to U.S. photo voltaic tariffs by shifting their huge operations to nations the place they won’t face duties – together with Southeast Asia.

The group, the American Alliance for Photo voltaic Manufacturing Commerce Committee, accused huge Chinese language photo voltaic panel makers with factories in Malaysia, Cambodia, Vietnam and Thailand of inflicting international costs to break down by dumping merchandise into the market.

The Hanwha-led group has sought antidumping responsibility charges of between 70.35% and 271.45%, relying on the nation, to offset the unfair pricing. It additionally has sought tariffs to fight unfair subsidies in these nations, and the Commerce Division imposed preliminary antisubsidy duties final month.

Most photo voltaic panels put in in the US are made abroad, and a few 80% of imports come from the 4 nations focused within the Commerce Division probe.

Tariffs would enhance costs for corporations that import panels to put in on rooftops or construct solar energy crops, however the US over greater than a decade has proven a willingness to impose duties on the sector in a bid to bolster the small U.S. clear power manufacturing trade.

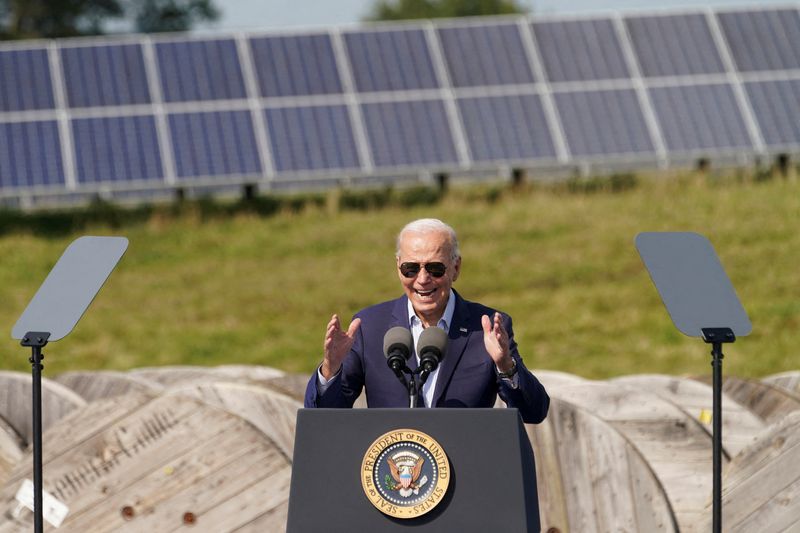

The Biden administration this yr raised the alarm over China’s huge funding in manufacturing unit capability for clear power items. Biden’s landmark local weather change regulation, the Inflation Discount Act, contains incentives for corporations that produce clear power gear in the US – a subsidy that has prompted a flurry of plans for brand spanking new photo voltaic factories.

President-elect Donald Trump has known as the Inflation Discount Act too costly, but in addition has mentioned he plans to slap hefty tariffs on a spread of sectors to guard American staff.

Dumping happens when an organization sells a product in the US at a worth under its value of manufacturing or decrease than what it prices in its dwelling nation.