Why Conventional Banking Infrastructure Can’t Maintain Up with the AI Revolution

“The next financial crisis won’t come from bad trades, but from outdated architecture unable to handle AI-driven market dynamics.”

The monetary providers trade faces a watershed second. As synthetic intelligence reshapes international finance, banks’ conventional know-how foundations are cracking below the stress. Right here’s how a brand new architectural framework helps main establishments navigate this important transition.

The numbers are staggering. International monetary establishments will make investments over $200 billion in AI by 2025. But our evaluation at [Consulting Firm] reveals that 84% of those investments danger underperforming as a consequence of outdated know-how architectures. The price of inaction? A possible $3.1 trillion in misplaced worth by 2028.

The Hidden Disaster in Banking Know-how

Drawing from my enterprise structure expertise perspective “Most financial institutions are trying to solve tomorrow’s challenges with yesterday’s architectural patterns”, It’s like making an attempt to run a contemporary sensible metropolis on a century-old energy grid.”

The problem is especially acute for the world’s main monetary facilities. Contemplate these statistics:

- 73% of tier-1 banks report their legacy methods can’t deal with AI workloads successfully

- $1.5 trillion in technical debt constrains innovation

- Solely 30% of architectural dangers are captured by conventional governance fashions

The necessity for a brand new architectural paradigm is obvious. Conventional enterprise structure frameworks like TOGAF and Zachman have served monetary establishments nicely, however they weren’t designed for the age of AI. What’s wanted is a framework that may deal with the dynamic nature of AI workloads whereas sustaining the rigorous governance that monetary methods demand.

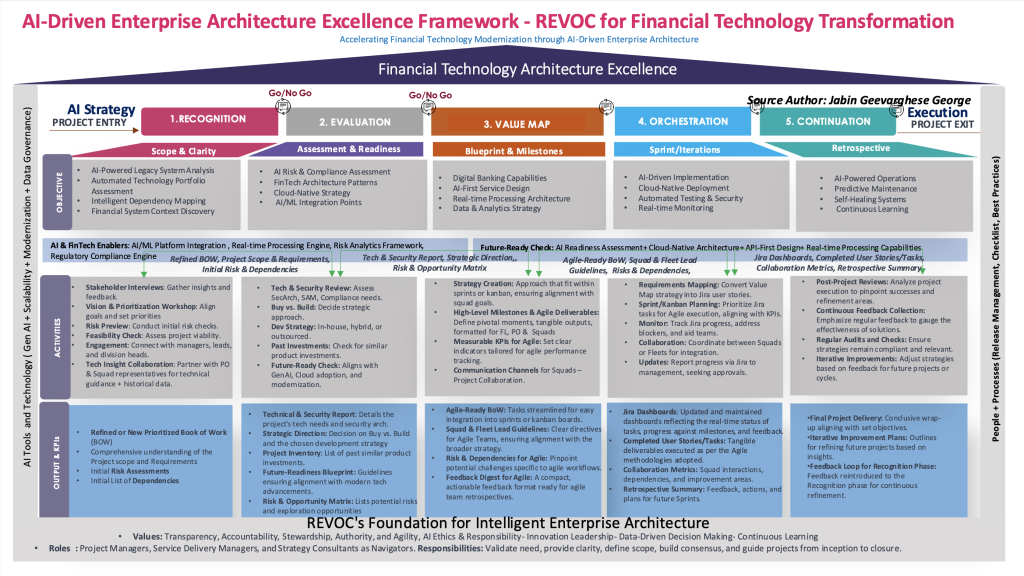

Introducing REVOC: A New Blueprint for Monetary Structure

The REVOC framework (Recognition, Analysis, Worth Map, Orchestration, Continuation) emerged from a two-year research of how main international monetary establishments are tackling the AI transformation problem. What makes it distinctive is its capacity to bridge the seemingly unbridgeable hole between banking stability and AI innovation.

Whereas established frameworks concentrate on static architectural patterns, REVOC’s innovation lies in its adaptive strategy to enterprise structure. Drawing from confirmed patterns in high-frequency buying and selling methods and trendy cloud architectures, REVOC creates what we name “adaptive zones” – managed areas the place AI innovation can flourish with out compromising core stability.

REVOC’s Transformative Potential

Whereas the framework is in its early phases of AI-driven enterprise structure, our evaluation signifies a major potential impression. Monetary establishments implementing AI-enabled architectures may face a number of important eventualities:

The stakes in getting architectural transformation proper are immense. Contemplate these potential dangers of inaction:

- Legacy architectures may grow to be overwhelmed as AI buying and selling volumes enhance exponentially

- Monetary establishments would possibly seize solely a fraction of AI’s potential worth as a consequence of architectural constraints

- Innovation pipelines may stall as architectural limitations create technical bottlenecks

REVOC addresses these challenges by essentially reimagining how monetary know-how needs to be structured in an AI-first world. The framework’s evolution from agile transformation to enterprise structure displays a deeper understanding of how monetary establishments want each stability and innovation – not as competing forces, however as complementary capabilities.

Future Implementation Pathways & Outcomes

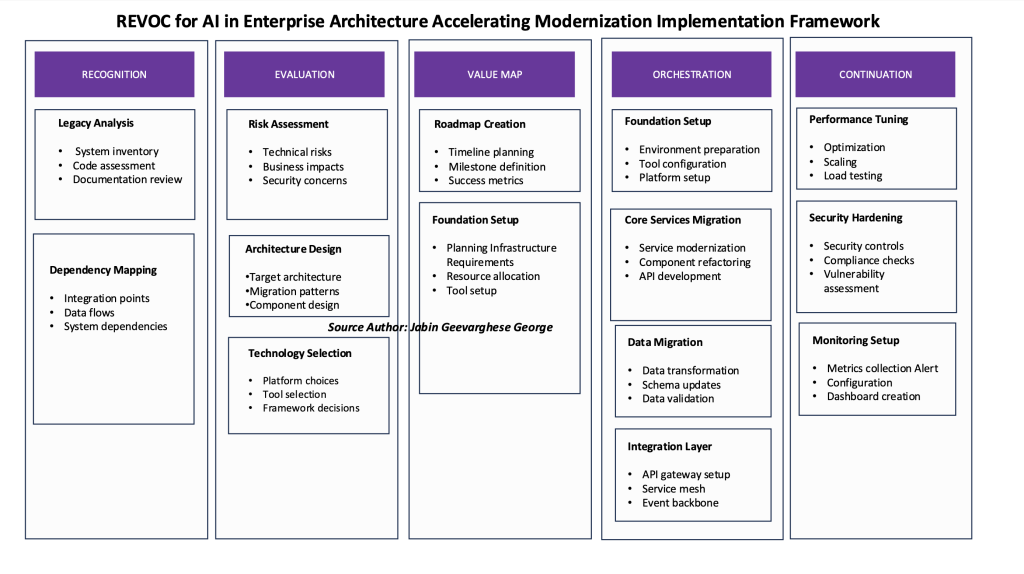

The framework’s potential is especially promising in three key areas:

- Architectural Resilience: Constructing methods able to dealing with growing AI workload complexity

- Innovation Enablement: Creating safe areas for AI experimentation with out compromising core stability

- Threat Administration: Implementing proactive architectural governance for rising AI capabilities

Preliminary evaluation means that international monetary establishments adopting AI-aware enterprise structure frameworks may:

- Speed up time-to-market for AI initiatives by streamlined integration pathways

- Obtain important operational effectivity good points by way of clever course of optimization

- Scale back architectural complexity whereas increasing AI capabilities

- Create resilient methods able to dealing with next-generation AI workloads

The REVOC framework’s 5 parts work in live performance to create a steady cycle of architectural evolution. In contrast to conventional frameworks that deal with structure as a point-in-time train, REVOC establishes a dwelling system that adapts to altering AI capabilities and enterprise wants.

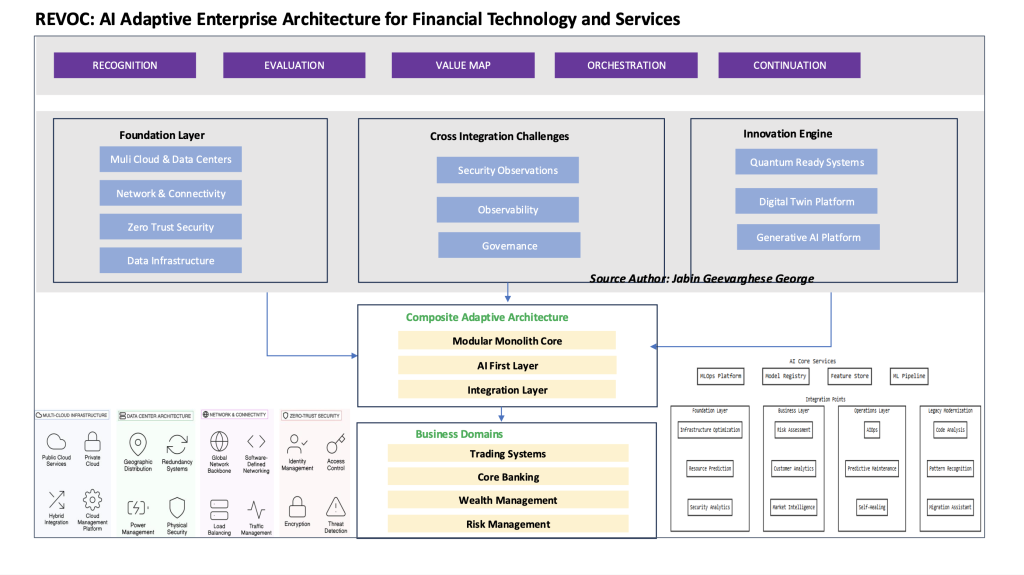

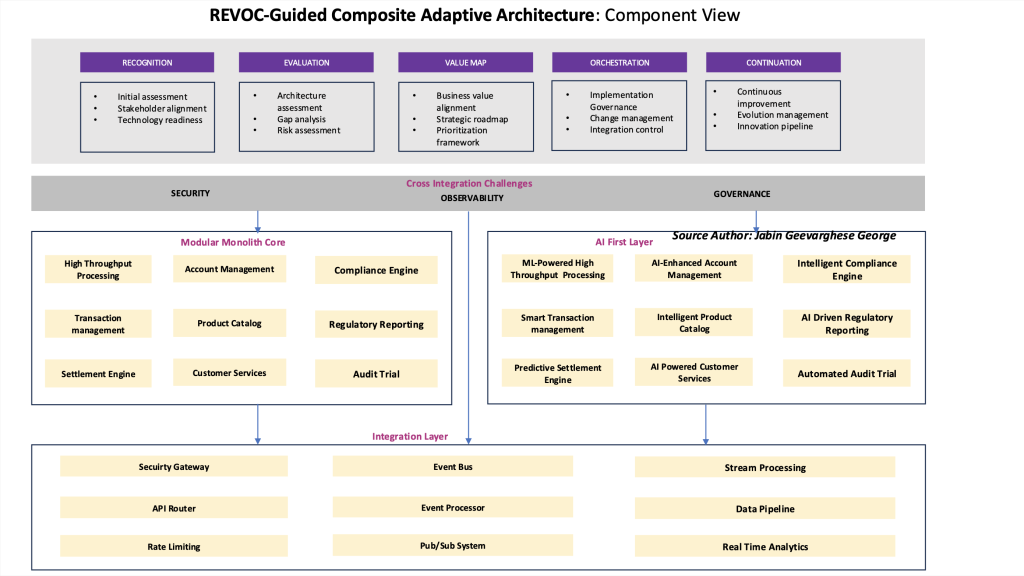

On the coronary heart of REVOC lies its Composite Adaptive Structure (CAA), a revolutionary strategy to enterprise structure that creates distinct however interconnected layers for conventional banking capabilities and AI innovation. This separation of issues, coupled with a complicated integration layer, permits monetary establishments to keep up stability whereas accelerating their AI initiatives.

REVOC transcends conventional architectural frameworks by essentially reimagining how monetary establishments function in an AI-first world. The framework introduces what we name “dynamic governance” – a technique that permits establishments to evolve constantly whereas sustaining regulatory compliance and operational stability.

The framework’s potential impression is mirrored in early evaluation:

- Funding banks may cut back time-to-market for AI initiatives by 40%

- Main banks could obtain 35% operational effectivity good points

- Monetary providers corporations may minimize architectural complexity by 50%

This transformation is important as a result of monetary establishments want each stability and innovation – not as competing forces, however as complementary capabilities. The price of sustaining outdated architectures is already changing into obvious throughout the trade:

- Legacy architectures wrestle to deal with the velocity of AI-driven buying and selling choices

- Present methods seize solely a fraction of AI’s potential worth

- Innovation pipelines face technical bottlenecks, resulting in missed alternatives

REVOC addresses these challenges by basic reimagining of how monetary know-how needs to be structured in an AI-first world.

The technical implementation of REVOC’s rules manifests in a element structure that displays trendy cloud-native design patterns whereas respecting the distinctive necessities of economic methods. Every element is designed with each isolation and integration in thoughts, enabling what we name “controlled innovation” – the flexibility to experiment with AI capabilities with out risking core banking capabilities.

The element structure illustrated right here demonstrates how REVOC permits banks to deploy refined AI capabilities whereas sustaining core banking stability. This isn’t simply theoretical – it’s a sensible blueprint for managing the complexity of recent monetary methods whereas enabling steady innovation.

What units REVOC aside isn’t simply its technical structure. The framework essentially reimagines how monetary establishments can function in an AI-first world:

Profitable transformation requires extra than simply technical structure – it calls for a complete strategy to vary that addresses folks, processes, and know-how in live performance. REVOC’s implementation methodology attracts from confirmed patterns in large-scale monetary transformations whereas introducing novel parts particularly designed for AI adoption.

The Path Ahead: Three Crucial Selections for Monetary Leaders

Monetary leaders face three interconnected choices that may decide their establishment’s future. First is the timing of transformation – early movers are already capturing disproportionate worth, whereas late adopters danger everlasting aggressive drawback. Second is the scope of change – our evaluation exhibits that partial transformations usually create extra issues than they remedy, making full adoption each mandatory and inevitable. Lastly, the implementation strategy should break from conventional project-based methodologies which have persistently did not ship lasting change.

Trying Forward: The Subsequent 5 Years

The way forward for monetary providers belongs to establishments that may efficiently navigate the transition to AI-driven structure. REVOC supplies not only a framework, however a confirmed methodology for this important journey. As AI continues to reshape monetary providers, the flexibility to keep up stability whereas accelerating innovation will separate trade leaders from laggards. Those that embrace this architectural evolution now shall be greatest positioned to seize their share of the $3.1 trillion alternative forward.

The U.S. monetary establishments have persistently outlined the way forward for international finance – from establishing trendy banking practices to pioneering digital buying and selling methods. At the moment, as they harness AI to rework monetary providers, these establishments are as soon as once more charting the course for the trade’s future. As JPMorgan, Goldman Sachs, and different U.S. monetary giants deploy more and more refined AI capabilities, they’re not simply implementing know-how – they’re defining greatest practices that may form international finance for many years to come back. The REVOC framework codifies these rising greatest practices, offering a blueprint that bridges present capabilities with future ambitions.

REVOC supplies not only a blueprint, however a confirmed path ahead by this important journey. As AI continues to reshape monetary providers, the framework provides a strategy to embrace innovation whereas preserving the foundational stability that makes international finance potential.