Throughout her annual OB-GYN go to, Callie Anderson requested about getting off the contraception capsule.

“We decided the best option for me was an IUD,” she mentioned, referring to an intrauterine machine, a long-acting, reversible sort of contraception.

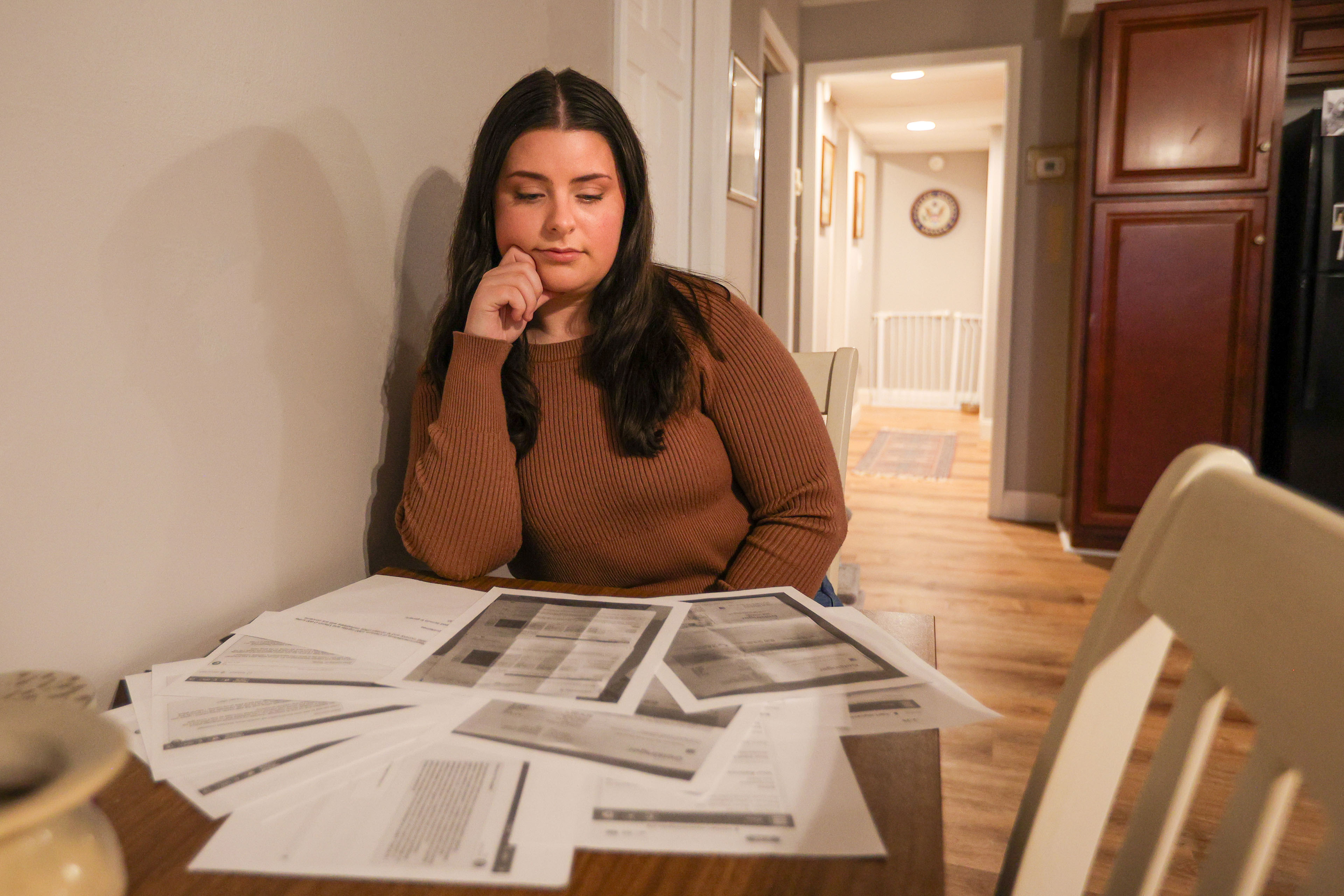

Anderson, 25, of Scranton, Pennsylvania, requested her physician how a lot it may cost a little. On the time, she was working in a U.S. senator’s native workplace and was coated below her father’s insurance coverage by a plan supplied to retired state police.

“She told me that IUDs are almost universally covered under insurance but she would send out the prior authorization anyway,” Anderson mentioned.

She mentioned she heard nothing extra and assumed that meant it was coated.

After ready months for an appointment, Anderson had the insertion process final March. She paid $25, her copay for an workplace go to, and all the pieces went nicely.

“I was probably in the room itself for less than 10 minutes, including taking clothes on and off,” she mentioned.

Then the invoice got here.

The Medical Process

Based on Deliberate Parenthood, IUDs and implantable contraception represented almost 25% of its contraceptive providers offered from October 2021 to September 2022, per the newest information obtainable.

There are two varieties of IUDs: copper, which Deliberate Parenthood says can shield in opposition to being pregnant for as much as 12 years, and hormonal, which may final from three to eight years relying on the model. Hormonal IUDs can forestall ovulation, and each sorts have an effect on the motion of sperm, designed to cease them from reaching an egg.

A doctor or different practitioner makes use of a tube to insert the IUD, passing it by the cervix and releasing it into the uterus.

Docs usually advocate over-the-counter medicine for insertion ache, a priority that prompts some sufferers to keep away from IUDs. Final 12 months, federal well being officers advisable docs talk about ache administration with sufferers beforehand, together with choices corresponding to lidocaine pictures and topical anesthetics.

The Closing Invoice

$14,658: $117 for a being pregnant check, $9,862 for a Skyla IUD, $4,057 for “clinic service,” plus $622 for the physician’s providers.

The Billing Downside: A ‘Grandfathered’ Plan

Anderson obtained a uncommon glimpse of what can occur when insurance coverage doesn’t cowl contraception.

The Reasonably priced Care Act requires well being plans to supply preventive care, together with quite a lot of contraceptives, with out price to the affected person.

However Anderson’s plan doesn’t need to adjust to the ACA. That’s as a result of it’s thought-about a “grandfathered” plan, that means it existed earlier than March 23, 2010, when President Barack Obama signed the ACA into legislation, and has not modified considerably since then.

It’s unclear what number of People have such protection. In its 2020 Employer Well being Advantages survey, KFF estimated that about 14% of coated staff have been nonetheless on “grandfathered” plans.

Anderson mentioned she didn’t know that the plan was grandfathered — and that it didn’t cowl IUDs — till she contacted her insurer after it denied cost. Her physician with Geisinger, a nonprofit well being system in Pennsylvania, was in-network.

“My understanding was Geisinger would reach out to insurance and if there was an issue, they would tell me,” she mentioned.

Mike McMullen, a Geisinger spokesperson, mentioned in an e mail to KFF Well being Information that with most insurance policy, “prior authorization is not required for placing birth control devices, however, some insurers may require prior authorization for the procedure.”

He didn’t specify whether or not it’s the well being system’s coverage to hunt such authorizations for IUDs, nor did he touch upon the quantity charged.

The Pennsylvania State Troopers Affiliation, which gives some retirees the plan that coated Anderson, didn’t reply to requests for remark. Highmark Blue Cross Blue Protect, the insurer, referred inquiries to the state.

Dan Egan, communications director for the state’s Workplace of Administration, confirmed in an e mail that the insurance coverage plan is a grandfathered plan “for former Pennsylvania State Troopers Association members who retired prior to January 13, 2018.”

A profit handbook for the plan identifies it as grandfathered and lists quite a lot of excluded providers. Amongst them are “contraceptive devices, implants, injections and all related services.”

The $14,658 invoice, an quantity that sometimes could be negotiated down by an insurer, was solely Anderson’s duty.

“Fourteen thousand dollars is astronomical. I’ve never heard of anything that high” for an IUD, mentioned Danika Severino Wynn, vp for care and entry on the Deliberate Parenthood Federation of America.

Prices for IUDs differ, relying on the sort, the place the affected person lives, insurance coverage standing, the supply of economic help, and extra medical components, Severino Wynn mentioned.

She mentioned most insurers cowl the gadgets, however protection can differ, too. As an example, some cowl solely sure sorts or manufacturers of contraceptives. Typically, an IUD insertion prices $500 to $1,500, she added.

Many suppliers, together with Deliberate Parenthood, have sliding-scale charges based mostly on revenue or can arrange cost plans for cash-paying or underinsured sufferers, she mentioned.

Based on FAIR Well being, a value estimation software that makes use of claims information, an uninsured affected person within the Scranton space may count on to be charged $1,183 for an IUD insertion executed at an ambulatory surgical procedure heart or $4,319 in a hospital outpatient clinic.

The Decision

Anderson texted and known as her insurer and Geisinger a number of instances, spending hours on the telephone. “I am appalled that no one at Geisinger checked my insurance,” she wrote in a single message with workers at her physician’s workplace.

She mentioned she felt rebuffed when she requested billing representatives about monetary help, even after noting the invoice was greater than 20% of her annual revenue.

“I wasn’t in therapy at the time, but at the end of this I ended up going to therapy because I was stressed out,” she mentioned. The billing workplace, she mentioned, “told me that if I didn’t pay in 90 days, it would go to collections, and that was scary to me.”

Finally, she was put in contact with Geisinger’s monetary help workplace, which supplied her a self-pay low cost knocking $4,211 off the invoice. However she nonetheless owed greater than she may afford, Anderson mentioned.

The ultimate supply? She mentioned a consultant informed her by telephone that if she made one lump cost, Geisinger would give her half off the remaining prices.

She agreed, paying $5,236 in whole.

The Takeaway

It’s all the time greatest to learn your profit booklet or name your insurer earlier than you bear a nonemergency medical process, to examine whether or not there are any exclusions to protection. As well as, name and converse with a consultant. Ask what you may owe out-of-pocket for the process.

Whereas it may be arduous to know whether or not your plan is grandfathered below the ACA, it’s price checking. Ask your insurance coverage plan, your employer, or the retiree advantages workplace that provides your protection. Ask the place the plan deviates from ACA guidelines.

With contraception, “sometimes you have to get really specific and say, ‘I’m looking for this type of IUD,’” Severino Wynn mentioned. “It’s incredibly hard to be an advocate for yourself.”

Most insurance policy supply on-line calculators or different methods to study forward of time what sufferers will owe.

Be persistent in looking for reductions. Supplier prices are virtually all the time increased than what insurers would pay, as a result of they’re anticipated to barter decrease charges.

Invoice of the Month is a crowdsourced investigation by KFF Well being Information and The Washington Submit’s Nicely+Being that dissects and explains medical payments. Since 2018, this collection has helped many sufferers and readers get their medical payments diminished, and it has been cited in statehouses, on the U.S. Capitol, and on the White Home. Do you could have a complicated or outrageous medical invoice you wish to share? Inform us about it!

[Correction: This article was updated at 9:30 a.m. ET on Jan. 31, 2025, to correct the spelling of Geisinger spokesperson Mike McMullen’s name.]