Nancy Hunt arrived at an emergency room from a Genesis HealthCare nursing house in Pennsylvania in such dreadful form, together with maggots infesting her gangrened foot, that the hospital referred to as an elder abuse hotline after which the police, her son alleged in a lawsuit.

Hunt died 5 days later. Her loss of life certificates stated the foot damage was a “significant” issue. Genesis denied wrongdoing however agreed to pay $3.5 million in a settlement Hunt’s son signed in August 2024.

But Genesis hasn’t paid most of that debt, court docket data present. It could by no means should.

As soon as the nation’s largest nursing house chain, Genesis says it was spending $8 million a month defending and settling lawsuits over resident accidents and deaths lately. However the firm is now poised to wipe the legal responsibility slate clear by searching for refuge in essentially the most protecting nook of the authorized system for the nursing house trade: chapter court docket.

The Genesis case, one in every of 11 massive senior care bankruptcies this yr, illustrates how well being care corporations can dodge public and monetary accountability for alleged negligence by means of delays, confidentiality clauses, and chapter maneuvers, a KFF Well being Information investigation discovered.

When it filed for chapter in Dallas in July, Genesis estimated its complete legal responsibility for practically a thousand settled and pending lawsuits at $259 million. A KFF Well being Information assessment of the phrases of 155 settlement agreements and company monetary statements exhibits Genesis officers knew insolvency was doable but included provisions in its settlement agreements permitting it to defer cost, usually for a yr or extra.

In consequence, Genesis paid nothing in 85 instances and solely a portion within the different 70, in accordance with civil court docket data and chapter claims made out there by means of individuals with entry to them. It nonetheless owes $41 million of the $58 million it had agreed to pay in these instances, the data present.

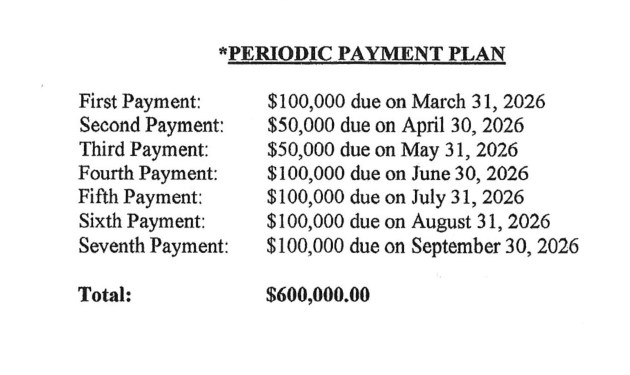

“It just feels like they killed my mom and got away with it,” stated Vanessa Betancourt, whose mom, Nellie Betancourt, a retired nurse, fractured her hip at a Genesis house in Albuquerque, New Mexico — an damage the health worker’s report stated led to her loss of life. Genesis agreed to a $650,000 settlement with Betancourt’s household in April below the situation it will not must pay the primary of seven installments for one more yr, in accordance with the settlement doc.

Genesis denied wrongdoing in all lawsuits and settlements. In a written assertion, the corporate didn’t reply questions on particular person private damage instances. The assertion stated Genesis remained “focused on delivering high-quality, compassionate care to our patients and residents without disruption” throughout chapter.

One lawsuit Genesis settled for practically $1 million alleged nursing house managers ignored repeated warnings a couple of male resident’s habits earlier than he sexually assaulted a feminine Alzheimer’s affected person, in accordance with court docket data. In a case the corporate resolved for $500,000, a Genesis nursing house was accused of delaying the hospitalization of a resident who had vomited brown mucus. He died of a bowel obstruction. Genesis has paid nothing for both settlement, in accordance with chapter claims.

Collectors, together with households of the deceased, are anticipated to salvage a fraction of what they had been promised, if something. On Dec. 10, the corporate’s homeowners had been scheduled to hunt approval by the U.S. Chapter Court docket for the Northern District of Texas to promote its nursing houses and different property to its largest investor, a non-public fairness agency. In court docket papers, attorneys for residents and different collectors say the advanced plan will stop them from pursuing Genesis’ new possession and different corporations they blame for the corporate’s collapse.

John Anthony, a chapter lawyer representing 340 private damage claims in opposition to Genesis, stated, “They never had any intention to honor these deals.”

Low Scores and Fines

Throughout years of economic turmoil, Genesis has ceaselessly struggled to offer top-notch care, federal data present. Utilizing its five-star system, the Facilities for Medicare & Medicaid Companies rated 58% of houses affiliated with Genesis as under common or a lot under common. CMS has fined Genesis houses $10 million for violating federal well being requirements over the previous three years.

In 2022, Connecticut well being regulators shuttered a Genesis house after two deaths and a number of violations. The corporate closed one other Connecticut nursing house this yr after residents twice had been evacuated over security considerations.

In its Chapter 11 submitting, Genesis stated it cared for about 15,000 residents in 165 nursing houses and 10 assisted residing services in 18 states. They’re centered in Pennsylvania, West Virginia, New Mexico, New Hampshire, New Jersey, Maine, Alabama, Maryland, and North Carolina, in accordance with the chapter submitting.

The corporate stated it owed $709 million in secured debt to lenders and the IRS. Below chapter guidelines, these money owed, backed by Genesis collateral, take priority over the $1.6 billion in unsecured debt Genesis stated it owes. Unsecured collectors embody a pension fund; contractors that supplied well being companies and tools; Pennsylvania, New Mexico, and West Virginia for unpaid supplier taxes; and former residents and their households who sued.

Risks in Reminiscence Care

Sandia Ridge Middle, a Genesis house in Albuquerque, was repeatedly faulted by well being regulators for not stopping sexual misbehavior in its reminiscence care unit. In November 2021, CMS cited the house for missing sufficient nurses to forestall sexual abuse amongst residents. An inspection report the next August recognized extra inappropriate sexual contact. Police had been referred to as to research sexual assault allegations in February and March of 2023, police experiences present; neither resulted in prison expenses.

Then in April 2023, a 61-year-old male resident with alcohol-related dementia sexually assaulted a feminine resident with Alzheimer’s within the eating room, in accordance with a police report and an inspection report. When the resident screamed for him to cease and that he was hurting her, he responded “shut up bitch I know you like this,” in accordance with a lawsuit introduced on behalf of the girl, recognized in court docket papers as R.S.

Sandia Ridge administration had been conscious of the male resident’s behavioral points for months, in accordance with worker depositions within the case. Police had investigated a prior sexual assault allegation in opposition to him the earlier yr with out bringing expenses. In a single deposition, a former actions assistant testified he hit her and twice pushed her into a rest room whereas saying, “I want to have sex with you.” When she reported him to a senior Genesis supervisor, she stated within the deposition, the supervisor put his finger over his lips and stated, “Shhh.”

The actions employee testified that R.S. used to fortunately sing together with Elvis Presley songs. After the assault, the employee stated, R.S. “don’t sing anymore.”

Inspectors cited the house for failing to guard R.S. The identical report stated the house didn’t present a therapist for one more feminine resident who was being sexually harassed. Medicare fined Sandia Ridge Middle $91,247. Genesis denied legal responsibility however settled R.S.’ lawsuit for $925,000 in Could, in accordance with the chapter declare.

“We just felt we have to hold them accountable,” R.S.’ daughter stated in an interview, talking on the situation that she and her mom not be recognized, due to the character of the assault. “Maybe I’m wrong, maybe I’m naive, but the only way to do that is to sue someone, right?”

Genesis has not paid any of the settlement, in accordance with the household’s declare submitting.

Development and Debt

Genesis’ downfall might be traced to 2007, when associates of two non-public fairness companies acquired the corporate in a $1.5 billion leveraged buyout, taking over substantial debt, in accordance with its chapter submitting. Personal fairness additionally has been concerned in different well being care bankruptcies, together with these of the HCR ManorCare nursing house chain, the jail well being care contractor Corizon Well being, and two for-profit hospital programs, Steward Well being Care and Prospect Medical Holdings.

In 2011, Genesis raised $2.4 billion by transferring considerably all its nursing house buildings and different actual property to Welltower, a publicly traded actual property funding belief, in accordance with Genesis’ chapter submitting. Genesis then rented the buildings again from Welltower, which made leasing prices a major expense.

Genesis went on a nationwide shopping for spree. At its peak in 2016, it had grown to greater than 500 nursing houses. In a court docket declaration, Louis Robichaux IV, a advisor overseeing Genesis’ chapter restructuring, wrote that as the corporate expanded, it grew to become tougher to handle and “mired in corporate inefficiencies.” Robichaux wrote that Genesis’ monetary woes had been exacerbated by quickly rising labor prices and lawsuits, together with some predating the covid pandemic.

Beginning in 2021, Genesis prevented chapter after receiving $100 million in loans from a non-public fairness agency based by Joel Landau, the proprietor of a Brooklyn-based nursing house chain, in accordance with Robichaux’s submitting.

However Genesis continued to teeter on the sting of insolvency. In audited monetary statements for 2022 and 2023 submitted to a California oversight company, administration and auditors stated hire and debt obligations raised “substantial doubt about the company’s ability to continue as a going concern.”

In a court docket submitting, a committee appointed by the U.S. Trustee’s Workplace to symbolize the unsecured collectors within the chapter accused Landau and Welltower of orchestrating a covert plan that allowed Welltower to maintain getting its rents whereas Landau might run the corporate and “siphon value to himself.” The committee alleged their efforts compelled the corporate into insolvency whereas “staffing levels and patient care declined precipitously.” Landau and Welltower didn’t reply to requests for remark.

Drawn-Out Lawsuits

Erin Pearson sued Genesis over the loss of life of her father, James Sanderson, a retired mining firm government who died in 2018 after spending lower than a month at Bear Canyon Rehabilitation Middle in Albuquerque. Within the reminiscence care unit, Sanderson fell repeatedly, suffered treatment errors made by nursing house employees, and developed a bowel obstruction and sepsis, in accordance with the lawsuit, filed in 2019. Pearson’s attorneys stated he was not hospitalized till eight days after nurses seen he was vomiting brown mucus.

After the decide rejected Genesis’ request to power Pearson into arbitration, Genesis appealed. It took 2½ years earlier than an appeals court docket affirmed the unique determination to let the case go ahead in court docket, data present.

This previous Could, greater than 5 years after suing, Pearson reached a $500,000 settlement, with the primary cost required by November, in accordance with a replica of the settlement. Nothing was paid, in accordance with the chapter declare.

“It was so drawn out and for so long,” Pearson stated in an interview, calling Genesis’ chapter “despicable.”

Payouts Postponed

Jennifer Foote, an Albuquerque lawyer who represents purchasers in a number of lawsuits in opposition to Genesis, together with Pearson’s, stated the corporate ceaselessly filed appeals. “They did not usually win them on these issues,” she stated, “and our sense was that they were doing it as a delay tactic.”

Genesis began utilizing installment funds round 2018, stated Dusti Harvey, Foote’s regulation associate. “The payments wouldn’t start for several months out,” Harvey stated. Foote stated Genesis’ attorneys usually wished to time the funds to begin the month the trial within the case was scheduled to happen.

Households needed to wait even when comparatively small quantities of cash had been concerned, settlement agreements present. Genesis’ settlement agreements additionally included a confidentiality clause prohibiting dialogue of the incidents.

Genesis agreed to pay $42,000 in a November 2024 settlement, however the first cost was not due till 9 months later. It was not paid, in accordance with the chapter declare.

A $250,000 settlement signed in October 2023 didn’t begin paying out till the next September. When Genesis declared chapter — 21 months after the case was resolved — it nonetheless owed $100,000, in accordance with the household’s declare.

‘We Never Found Out the Truth’

Settling instances allowed Genesis to keep away from the expense and publicity of a trial, at which particulars of how its nursing houses functioned may need been revealed. In October 2020, Margarett Johnson, a retired college bus driver, fell out of her wheelchair at a Genesis nursing house in Waldorf, Maryland, fracturing her jawbone, nostril, and neck, in accordance with a lawsuit introduced by her household. Johnson was despatched to a trauma middle and positioned on a ventilator. She died three months later, at age 76, from ventilator-associated pneumonia, the lawsuit stated.

“It looked like she was hit by a truck,” Angelina Harley, one in every of her daughters, stated in an interview. “I knew my mom was not going to come home. I knew the Lord was not going to punish her more.”

The corporate denied negligence and blamed the accident on Johnson’s jacket getting tangled within the wheel of her wheelchair, in accordance with the lawsuit. Harley and her sister Angela Swann had been doubtful.

“We never found out the truth,” Harley stated. “They wanted to settle out of court.”

The corporate denied legal responsibility however agreed to a $950,000 settlement in October 2024. It by no means paid the ultimate $112,500 installment, in accordance with a letter Johnson’s 5 kids despatched to the chapter decide.

“If you settle out of court, you know doggone well you did something wrong,” Harley stated.

Maddening Judges

By summer time 2025, judges in some civil instances had run out of persistence.

Alma Brown, a retired day care supervisor and accordion instructor residing in a Genesis nursing house in Clovis, New Mexico, suffered falls, infections, bedsores, and different neglect that hastened her loss of life in 2023, in accordance with her property’s lawsuit. In Santa Fe District Court docket, Choose Kathleen McGarry Ellenwood castigated Genesis after it did not pay $2 million of the $3 million settlement to Brown’s property or clarify the delay.

Genesis “obviously benefited by not having to go to trial,” McGarry Ellenwood stated in a single listening to, in accordance with a court docket transcript. “They assure me that they’re not trying to renege on their contract, but it certainly seems like they haven’t lived up to what the bargain was.”

Genesis declared chapter the day McGarry Ellenwood introduced she would impose greater than $100,000 in fines, plus $10,000 extra every day till the settlement was paid.

In Pennsylvania, Greg Hunt petitioned a decide to punish Genesis after it stopped funds of the $3.5 million settlement after the loss of life of his mom, Nancy, the resident with the gangrenous foot. She had spent eight months in 2019 at Brandywine Corridor, a Genesis facility in West Chester that was later offered and renamed.

In a submitting with the Frequent Pleas Court docket of Montgomery County, Genesis admitted it was in arrears however requested the decide for extra time, citing “unforeseen and exigent financial challenges.” Genesis stated take care of sufferers at its nursing houses would endure if it needed to pay instantly.

Unswayed, Choose Richard Haaz in June ordered Genesis to pay up, together with punitive curiosity. However the chapter court docket stayed that order. Genesis nonetheless owes $1.4 million of the $2 million it was purported to pay, in accordance with Hunt’s declare. (The remainder of the $3.5 million settlement is meant to be paid by an insurer in January 2026.) Ian Norris, Hunt’s lawyer, declined to remark, citing confidentiality provisions within the settlement.

Court docket data point out Genesis attorneys by no means disclosed in both case that it was getting ready to declare chapter.

‘Bankruptcy as a Tool’

Within the first 9 months of 2025, 10 different senior residing corporations with liabilities over $10 million entered Chapter 11 chapter, in accordance with Gibbins Advisors, a consulting agency.

Hamid Rafatjoo, a chapter lawyer representing nursing houses who shouldn’t be concerned within the Genesis chapter case, stated filings might enhance because the trade has grow to be costlier to run and sophistication motion lawsuits have grow to be a fixture.

“Nursing homes get sued all the time for everything,” Rafatjoo stated. “A lot of operators wait too long to use bankruptcy as a tool.”

On Dec. 1, Genesis introduced the outcomes of its public sale, saying it had elected to promote its property to a non-public fairness agency managed by Landau. In a court docket submitting, Anthony, the lawyer for the private damage claimants, alleged the public sale was stacked in Landau’s favor regardless of an “objectively better and higher competing bid” from one other non-public fairness investor that will have supplied extra money to collectors. Genesis stated in its assertion that Landau’s group had elevated its bid in the course of the public sale.

Sen. Elizabeth Warren (D-Mass.) and two different senators final month requested the U.S. Trustee’s Workplace to intervene within the case, out of concern that “individuals who already own or control Genesis are trying to sell it to themselves, wiping away legal and other creditor debts in the process.” Legal professionals representing these accountable for the public sale didn’t reply to a request for remark.

Households of former Genesis residents stated they worry the capability to purge lawsuits by means of chapter emboldens nursing house homeowners who present poor care.

“They can file bankruptcy again,” stated Gabe Betancourt, whose spouse, Nellie, died after her keep at Uptown Rehabilitation Middle in Albuquerque. “And we’re the ones that will pay for it, with our memories, our lives.”