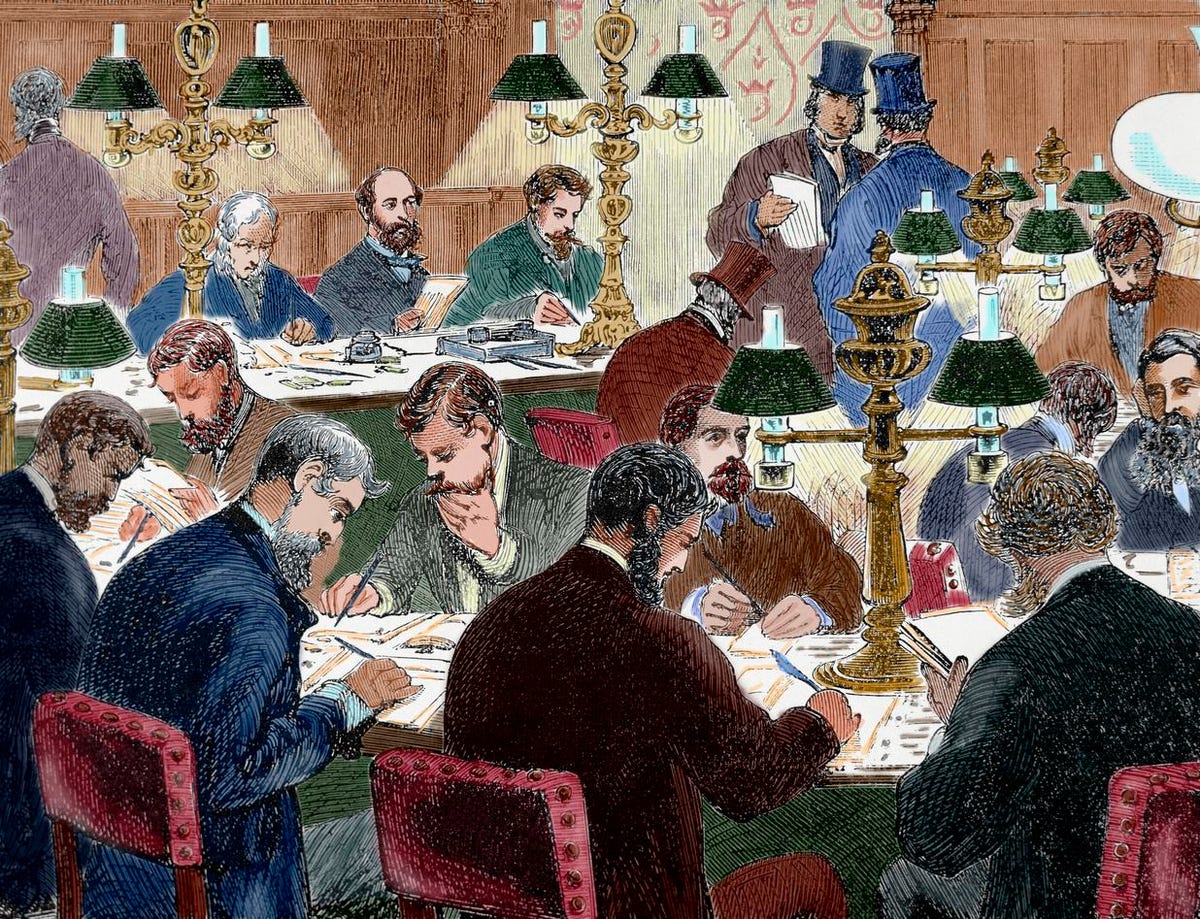

(Photo by Ipsumpix/Corbis via Getty Images)

People often ask me, “Are you a Fiduciary?” While I believe I understand the intent of why they are asking that question (lately there have been a lot of TV commercials advertising what it means), the meaning of fiduciary is a little more complicated than that simple question.

Some people may have also read that many “so-called” financial advisors do not have to work in the best interest of their clients (as a fiduciary does). You see, most advisors are employed by a company, whose interests they are paid to uphold.

Making things worse is the fact that many people simply refer to any financial professional as a financial advisor. Let’s start with discerning between not a fiduciary, but suitable, and fiduciary registrations.

A “suitable” Registered Representative

A Registered Representative, aka stockbroker or broker for short, buys and sells securities for their customers. Like many things were purchased, cars, washing machines, etc. they are paid through a commission. They are held to a suitability standard, which is less strict than the fiduciary standard. You can go to BrokerCheck to find out if someone is a Registered Representative.

Who is a Fiduciary Investment Adviser Representative?

By contrast, the term investment advisor (also spelled as “adviser” see below) is a legal term that refers to an individual or company that is registered as such with either the Securities and Exchange Commission (SEC) or a state securities regulator

MORE FOR YOU

To find out if you are working with an investment adviser representative, you can go to the Securities Exchange Commission’s Investment Adviser Public Disclosure database.

Both Representatives and investment adviser representatives may hold advanced designations that are not necessarily fiduciary. The Chartered Financial Analyst or CFA is considered the premier investment designation. That said, unless the Chartered Financial Analyst holds the Series 65 registration then they are not held to a fiduciary standard.

In the investment industry, a true fiduciary works in the best interests of their clients. The Centre for Fiduciary Excellence and The Center for Fiduciary Studies define a fiduciary as “someone who is providing investment advice or managing the assets of another person and stands in a special relationship of trust, confidence, and/or legal responsibility.”

A fiduciary keeps the interests of their client ahead of their own

Passing the Series 65 Exam is not the end-all

At the most basic level, investment adviser (not advisor) representatives who pass the Uniform Investment Adviser Law Exam (Series 65 Exam), are held to this standard. These representatives work in firms called a registered investment adviser. Thus, the firm is also a fiduciary.

I liken the Uniform Investment Adviser Law Exam registration as “just getting over the hurdle,” but not by much. Upon passing the Series 65 exam, an investment adviser representative does not have to earn continuing education credits to further their knowledge, such as the Certified Financial Planner designation. In these cases, those who seek that designation have done far more work than just “clearing the hurdle.”

The Uniform Investment Adviser Law Exam, is an exam about law and not investing. While not required, some professionals may have a Finance degree, have an investment designation such as the Chartered Financial Analyst.

An impressive title like Vice President on a business card does not indicate investment knowledge. You may have heard the term assets under management or AUM. That is simply an indicator of the volume of money that the adviser or often their firm is managing. It doesn’t indicate how their risk adjusted returns compare to other firms. More importantly how effective they are in providing clients risk adjusted returns appropriate for their goals

Fortunately, FINRA has a page to help you learn more about Professional Designations. They even have a page for so-called “Accredited Designations.” These 11 designations have been certified by either the American National Standards Institute or the National Commission for Certifying Agencies.

However, the Financial Industry Regulatory Authority does not endorse any designation. So you should do your own research to determine if a professional with or without designation fits your needs.

Dually Registered: Fiduciary and Non-Fiduciary Status

Confusing things a bit, some investment adviser representatives are also registered as Registered Representatives. An argument for this dual registration is allowing more options to show clients and the ability to help smaller account sizes. However, this allows them to go back and forth between a fiduciary and non-fiduciary status. That often leads to clients to be confused when the fiduciary light is on or off.

This dual registration comes with the Registered Representative title. In this case, the registered representative aka financial advisor will most often sell a mutual fund, which includes an embedded commission. The discernment between “commission” and “fee” (which is more transparent) is the beginning of the confusion. Many people often perceive the fee to be an extra cost, as compared to those who don’t see the cost, commission, and feel as though that they pay nothing.

A Certified Financial Planner (CFP) fiduciary definition matters

A Certified Financial Planner (CFP) passes a 12 hour board exam and spend three years delivering financial planning services to clients BEFORE they are able to claim this designation. Depending upon the year that they get this designation, they also have to hold an undergraduate degree. I

With the CFP Certificate, an advisor does not only have to pass the board exam and qualifying tests but also take 30 hours of continuing education every 2 years to to improve their knowledge. The Certified Financial Planner® designation is the only accredited designation that some states view as satisfying their investment advisor representative requirements.

If your planner claims to be a CFP, you can (and should) verify that, along with determining if there are any blemishes on the person’s record. The Certified Financial Planner Board of Standards mandates that a CFP act as a fiduciary in all his or her dealings. That can help you navigate the potential conflicts that come from the blurring of lines I also noted earlier.

CFP Pros pledge to honor a Standards Of Conduct that includes At all times when providing Financial Advice to a Client, a CFP® professional must act as a fiduciary, and therefore, act in the best interests of the Client. While they may be dually registered they pledge to Disclose And Manage Conflicts Of Interest

The Fiduciary Takeaway

What’s in a name? When it comes to the term financial advisor, we see there are many interpretations as well as many regulators. It is best to clarify what registrations, licenses, and professional designations your person has. A

s Ronald Reagan once said, “Trust but verify.” We have given a few routes for verification to get you started. You may be wise to check credentials every so often as records can change.