By Tom Wilson

(Reuters) – Advocates and holders of crypto will quickly affect U.S. coverage on the rising expertise after a slew of nominations and advisory appointments by President-elect Donald Trump, who takes workplace on Monday.

The crypto business has spent years combating lawsuits and enforcement actions by the U.S. authorities. It hopes the incoming Trump administration will mark a shift in coverage.

Political appointees will likely be vetted for potential conflicts. Some have dedicated to promoting their pursuits.

The business is internet hosting a sold-out black tie ball in Washington on Friday, with tickets starting from $2,500 to $10,000. David Sacks, Trump’s synthetic intelligence and crypto czar, is scheduled to attend.

Beneath are some information on the crypto positions of key members of the incoming administration and Trump’s inside circle.

SCOTT BESSENT

A billionaire hedge fund supervisor, Trump’s decide to be Treasury Secretary has spoken favorably about crypto.

“Crypto is about freedom and the crypto economy is here to stay,” he advised Fox Information in July. “I think everything is on the table with bitcoin.”

Based on a monetary disclosure filed final month, Bessent holds shares in a BlackRock (NYSE:) bitcoin exchange-traded fund price between $250,001 and $500,000. Bessent will divest his pursuits within the fund and different investments inside 90 days of his affirmation, he wrote final week to the U.S. Treasury.

Bessent didn’t reply to a request for remark.

HOWARD LUTNICK

Trump’s alternative for Secretary of Commerce is a vocal supporter of bitcoin.

Lutnick is CEO of New York brokerage agency Cantor Fitzgerald, which earns charges to handle billions of {dollars}’ price of U.S. Treasuries for , the corporate that points the eponymous stablecoin.

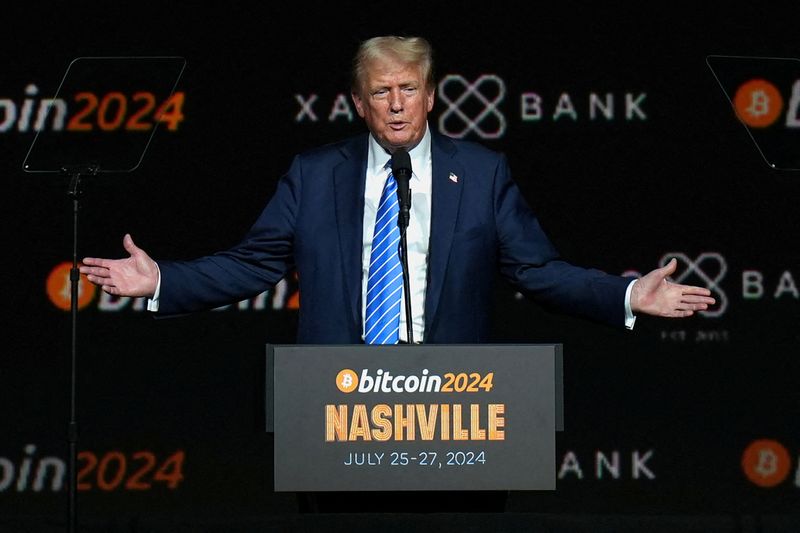

“Do I own bitcoin? Of course I do,” Lutnick stated on the 2024 convention in July. “Does Cantor Fitzgerald own bitcoin? A shedload of bitcoin.”

Lutnick didn’t reply to a request for remark.

ELON MUSK

The Tesla (NASDAQ:) chief and world’s richest man, chosen by Trump to supervise a authorities cost-cutting effort, the so-called Division of Authorities Effectivity, has lengthy championed crypto together with bitcoin and dogecoin.

His public feedback and actions of his corporations have lately influenced the worth of bitcoin and dogecoin, a smaller token conceived as a joke throughout an earlier crypto bubble.

The acronym for Musk’s cost-cutting company, DOGE, is a nod to dogecoin, which is now the world’s seventh-biggest crypto token primarily based on its circulation of $4.5 billion, based on information supplier CoinGecko.

In 2021 Tesla purchased $1.5 billion of bitcoin, changing into one of many largest corporations to personal crypto earlier than promoting most of its holdings. It held unspecified digital property totaling $184 million in September 2024, an organization monetary report confirmed.

Musk didn’t reply to a request for remark despatched by way of Tesla on what crypto property he could maintain.

VIVEK RAMASWAMY

Set to work with Musk at DOGE, the previous presidential candidate and entrepreneur is the founding father of Attempt Asset Administration.

Attempt, which stated in September it managed over $1 billion in property, final month filed to launch an exchange-traded fund that invests in company bonds for bitcoin investments.

The corporate’s wealth administration arm, launched in November, seeks to combine bitcoin into Individuals’ funding portfolios, Ramaswamy stated in a press launch.

In June 2023, Ramaswamy held $100,001 to $250,000 of bitcoin and $15,001 to $50,000 price of the smaller token ether, based on a monetary disclosure.

He didn’t reply to a request for remark.

DAVID SACKS

A former PayPal (NASDAQ:) government, Sacks was appointed White Home synthetic intelligence and crypto czar in December, tasked with creating a U.S. authorized framework lengthy sought by the crypto business.

Sacks is a co-founder of enterprise capital agency Craft Ventures. The agency has invested in crypto corporations together with BitGo and Bitwise, its web site exhibits.

Sacks didn’t reply to requests for remark.

STEVE WITKOFF

Trump’s Center East envoy Steve Witkoff, an actual property tycoon and donor to the incoming president, based crypto enterprise World Liberty Monetary in November.

World Liberty, which sells a proprietary token, lists on its web site Trump as amongst these entitled to a big share of any of the corporate’s revenues.

Witkoff didn’t reply to requests for remark.

ERIC TRUMP, DONALD TRUMP JR., BARRON TRUMP

Eric Trump advised Reuters final yr he was very concerned in World Liberty, which he, his elder brother Don Jr. – seen as probably the most influential member of the family within the presidential transition – and youthful half-brother Barron helped to kind.

Eric advised a bitcoin convention in December the expertise was a “financial revolution,” and that his father would make america the crypto capital of the world.

JD (NASDAQ:) VANCE

U.S. Vice President-elect Vance held between $250,001 and $500,000 in bitcoin in August 2024, based on a monetary disclosure.

The enterprise capital agency co-founded by Vance, Narya, has made investments in Attempt, Ramaswamy’s asset administration firm, and video platform Rumble, its web site exhibits.

In November, Rumble stated it will allocate its extra money reserves to bitcoin. The corporate additionally acquired final yr a $775 million funding from stablecoin agency Tether.

Requested for touch upon the crypto stances of Vance and Trump’s sons, Trump-Vance transition spokesperson Brian Hughes stated – with out offering proof – that bureaucrats in Washington had sought to stifle innovation with extra regulation and better taxes.

“President Trump will deliver on his promise to encourage American leadership in crypto and other emerging technologies,” he stated in a press release to Reuters.

PAUL ATKINS

Atkins, a lawyer and former prime SEC official, is Trump’s alternative to steer the Securities and Change Fee and has advocated for deregulation. He’s anticipated to take a softer method to crypto than present Chair Gary Gensler.

Atkins is chief government of Patomak World Companions (NYSE:), a consultancy. Patomak advises “cutting-edge crypto-native companies” and conventional monetary corporations on easy methods to “leverage digital assets for growth,” its web site says.

Atkins didn’t reply to a request for remark.