Twitter and Mr. Musk have been, so far, working together to close the deal, a person with knowledge of the matter said, though those dynamics can quickly change.

How Elon Musk’s Twitter Deal Unfolded

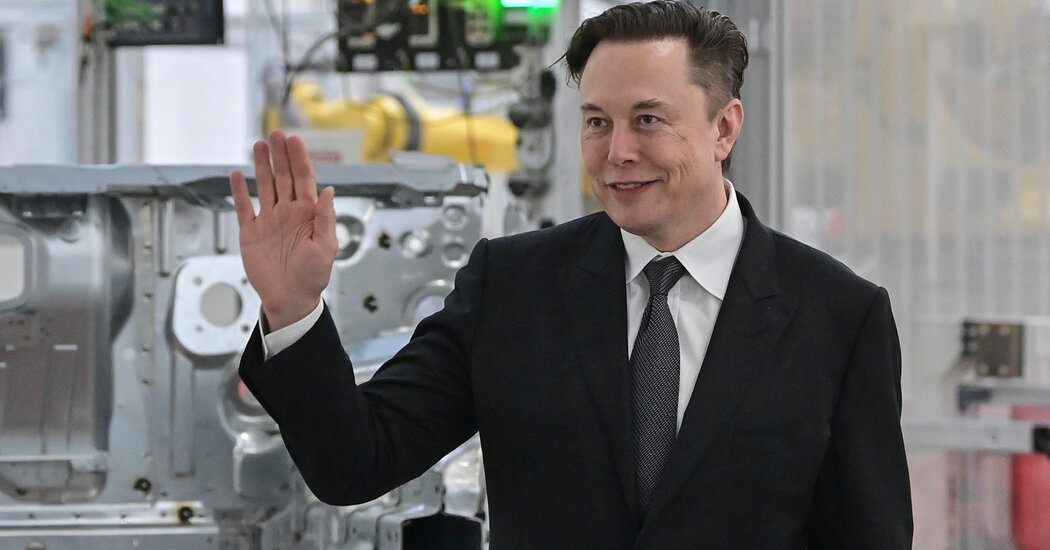

A blockbuster deal. Elon Musk, the world’s wealthiest man, capped what seemed an improbable attempt by the famously mercurial billionaire to buy Twitter for roughly $44 billion. Here’s how the deal unfolded:

Mr. Musk’s hand might be strengthened by the uncertainty his bid has created within Twitter, which could potentially make it harder for the company to continue independently. The company has struggled to add users and generate more revenue, and on Thursday, Mr. Agrawal fired two top executives, halted new hiring and pledged to slash spending.

In his tweets on Friday, Mr. Agrawal said he was making changes because the deal with Mr. Musk was not “an excuse to avoid making important decisions for the health of the company.” He added that Twitter was part of an industry that was “in a very challenging macro environment — right now.”

Mr. Musk has pledged to use his personal fortune to finance the deal for Twitter, a plan that has been affected by a recent plunge in stock prices, including Tesla’s. Tesla’s stock has fallen nearly 30 percent in the past month. Mr. Musk is both selling Tesla shares and putting them up as collateral for personal loans to raise cash.

If a deal were to be completed, business challenges at Twitter could force Mr. Musk to draw further on his Tesla stock to plug potential financial holes. And any problem at Tesla that caused its stock to fall far enough could trigger clauses in Mr. Musk’s personal loans that would require him to add more collateral, limiting his ability to invest in Twitter.

Tesla’s stock rose on Friday after Mr. Musk’s comments.

The fluctuations in shares of Twitter and Tesla that followed Mr. Musk’s tweets could draw scrutiny. The Securities and Exchange Commission charged Mr. Musk with securities fraud in 2018 after he falsely tweeted that he had secured funding to take Tesla private, sending the automaker’s shares up 6 percent. Mr. Musk and Tesla paid a $40 million penalty for the tweet. A shareholder lawsuit against Mr. Musk over the tweet is ongoing.

“If I were his lawyer, I would be spending the morning scrambling to figure out what the implication of this all is under the federal security law,” said Marc Leaf, partner with Faegre Drinker and a former lawyer with the Securities and Exchange Commission.