By Richa Naidu and Dhwani Pandya

LONDON/MUMBAI (Reuters) – For years, the world’s largest condom maker Reckitt Benckiser (LON:) designed merchandise and advertising and marketing to lure Indian males to its Durex model. Now, it’s pushing a development technique by betting on ladies and rural shoppers.

India final 12 months surpassed China to turn into the world’s most populous nation, however nonetheless fares poorly on using contraceptives. India’s authorities estimates solely round 10% of males use condoms and for ladies, sterilization stays the favored type of contraception.

Social stigma surrounding intercourse – which some say stems from Victorian social norms established throughout British colonization – has for many years marginalized feminine pleasure within the Indian society.

However attitudes are altering and Reckitt is shifting advertising and marketing gears to reap the benefits of an upswing in condom use amongst Indian ladies – now a key audience for Durex.

Round 9.5% of married Indian ladies cited utilizing condoms throughout intercourse by 2021, virtually double the use 5 years earlier, in keeping with newest obtainable authorities statistics. Amongst single ladies, such use greater than doubled to 27%.

Reckitt is reformulating merchandise similar to lubricants aimed toward attracting ladies shoppers, and has new advertising and marketing campaigns, Pankaj Duhan, Reckitt’s senior vice chairman of intimate wellness, instructed Reuters in an interview.

The Durex lubricants in India will use improved formulations to enchantment to ladies and have been created after performing medical research to handle considerations females face — 30% of Indian ladies expertise some discomfort when having intercourse with their companion.

“We want to change this … That is why we are relaunching our lubes portfolio,” stated Duhan. “The women tend to become a little bit more underserved consumer groups.”

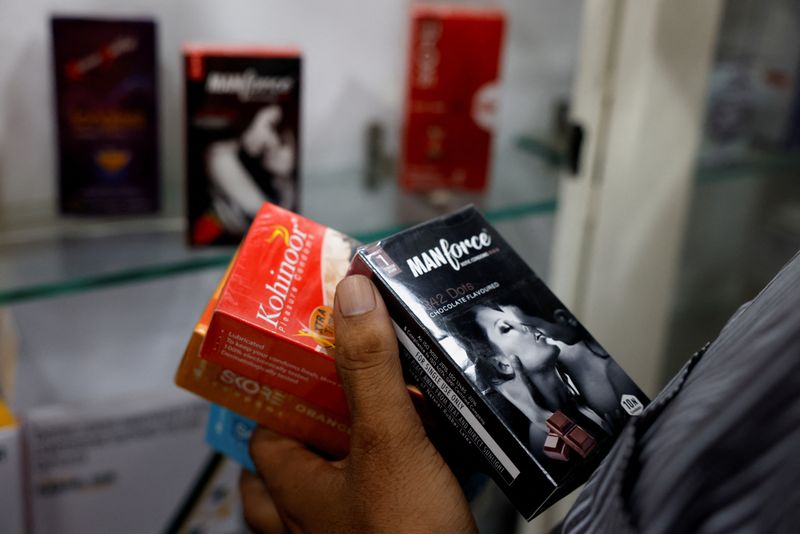

The India condoms market is presently dominated by Mankind Pharma, which makes Manforce, adopted by Reckitt and TTK Healthcare.

CHALLENGES

The British shopper items agency faces some stiff challenges in its quest to carve out a profitable slice of the feminine condom market and rural shoppers, primarily with distribution and pricing – two areas trade watchers imagine are key to success – but additionally in coaxing a still-largely conservative rural inhabitants to purchase its merchandise.

Furthermore, rivals are making a pitch to ladies too, with Durex’s fundamental rival and market chief Manforce tweaking its advertising and marketing — a current advert stars a Bollywood actress speaking about advantages of condoms and asking ladies to “go buy your own.”

“One challenge Reckitt may face is consistency of messaging,” stated Devangshu Dutta, head of retail consultancy Third Eyesight, including the corporate wants to determine whether it is focusing on condoms for well being, household planning, or pleasure as there might be totally different messaging for every kind of customer.

The expansion alternative is compelling – India’s condom market measurement is merely value $210 million, in comparison with China’s $4.1 billion, however is forecast to develop at 7.4% compound annual fee between 2024 and 2030, in keeping with Indian consulting agency 6Wresearch. The worldwide market is value $11.3 billion.

Rising the market will take some doing although, not least due to India’s huge measurement and thousands and thousands of mom-and-pop shops require a widespread distributor community.

Presently, solely about 10-15% of Durex’s gross sales in India come from rural areas, which is way extra worth delicate than city cities.

“Distribution is the big challenge simply because even though most consumer goods companies have made their way to all pincodes in the country, the question is maintaining availability at retail points,” stated Dutta of Third Eyesight.

CHIPPING AWAY AT TABOOS

Intercourse training within the conservative nation can be lagging, and there’s a huge gulf between consciousness and precise use of contraceptives.

Matt Godfrey, government vice chairman for Asia Pacific at Monks advert company, a part of S4Capital, stated advertising and marketing tweaks by the likes of Durex are a welcome change however condom use and intercourse training want to enhance in India.

“There are significant societal and cultural aspects that need to be rapidly shifted to reverse the status quo,” he stated.

Within the japanese state of Odisha, for instance, a small medical retailer of Sudam Padhan doesn’t prominently show condoms as “people frown upon them.”

In India, it is males who principally purchase condoms, however some like Pooja, a marketer in Mumbai, try to drive change. She made an “awkward” choice to purchase condoms herself for the primary time this 12 months, saying “when I’m asking for a condom over the counter I am basically putting my health first.”

Nonetheless, in a telling signal of the considerably taboo nature of the subject, the 31-year-old declined to share her final identify as she is single and feared societal admonition.

“An open dialog encouraging protected and accountable intercourse in India has been steadily progressing however must be regularly supported” by brands including Durex, S4Capital’s Godfrey said.

Like many of its rivals, Reckitt has over the years largely focussed on Indian men, with many ads featuring women wearing skimpy clothes.

Rival Manforce Condoms features former pornstar Sunny Leone in videos, some labelled “EXCLUSIVE UNCENSORED”. Duhan said many of the condom ads “objectified ladies.”

But that’s changing. Durex earlier this year launched a risqué “Explorers Wished” lubricants campaign in India which featured sensual shots of nude male body parts.

PRICING PAINS

Pricing is another big challenge, especially in stores in smaller towns and villages which are reluctant to stock condoms and lubes. Duhan said products have to be “extraordinarily low cost” to sell in some rural areas, where many use free government-provided condoms.

Padhan, from the medical store in Odisha, doesn’t stock Durex “as a result of they’re expensive and there is not any demand for them in rural areas,” and says most sales are of Ustad “Deluxe (NYSE:) Condoms” made by a state-run agency.

Ustaad prices simply 10 rupees (11 U.S. cents) for a pack of six. A pack of 10 Durex condoms begins retailing at round 250 rupees, with some priced above $6, and an identical pack of Manforce begins at $1.

However the smaller three-condom Durex pack begins retailing round 99 rupees, and Reckitt believes they may promote higher in rural India.

“We are starting at the top (and) planning to get down to the rural areas,” Duhan stated. “It’s a massive undertaking”.