By Joe Money and Duncan Miriri

BEIJING/NAIROBI (Reuters) – China will urge a summit of fifty African nations in Beijing this week to take extra of its items, earlier than Western curbs kick in on its exports comparable to electrical automobiles and photo voltaic panels, in trade for extra pledges of loans and funding.

However the dozens of African leaders arriving within the Chinese language capital for the three-yearly occasion is probably not simple bait. They are going to need to hear how China plans to fulfill an unfulfilled pledge from the earlier summit in 2021 to purchase $300 billion of products.

They may also search assurances on the progress of incomplete Chinese language-funded infrastructure initiatives, comparable to a railway designed to hyperlink the larger East African area.

“The prize is going to go to those countries who have carefully studied the changes in China and align their proposals with China’s new slimmed-down priorities,” mentioned Eric Olander, co-founder of the China-International South Mission.

“That’s a big ask for a continent that generally has very poor China literacy.”

Africa’s greatest two-way lender, investor and commerce accomplice is transferring away from funding big-ticket initiatives within the resource-rich continent, preferring as a substitute to promote it the superior and inexperienced applied sciences Chinese language companies have invested in closely.

As Western curbs on Chinese language exports loom, Beijing’s prime precedence can be discovering consumers for its EVs and photo voltaic panels, areas the place the U.S. and European Union say it has overcapacity, and constructing abroad manufacturing bases for rising markets.

China has already began tweaking situations for its loans to Africa, setting apart extra for photo voltaic farms, EV vegetation and 5G Wi-Fi amenities, whereas reducing again on bridges, ports and railways.

Final 12 months, China provided 13 loans of simply $4.2 billion to eight African states and two regional banks, knowledge from Boston College’s International Growth Coverage Centre confirmed, with about $500 million for hydropower and photo voltaic initiatives.

GEOPOLITICAL JOSTLING

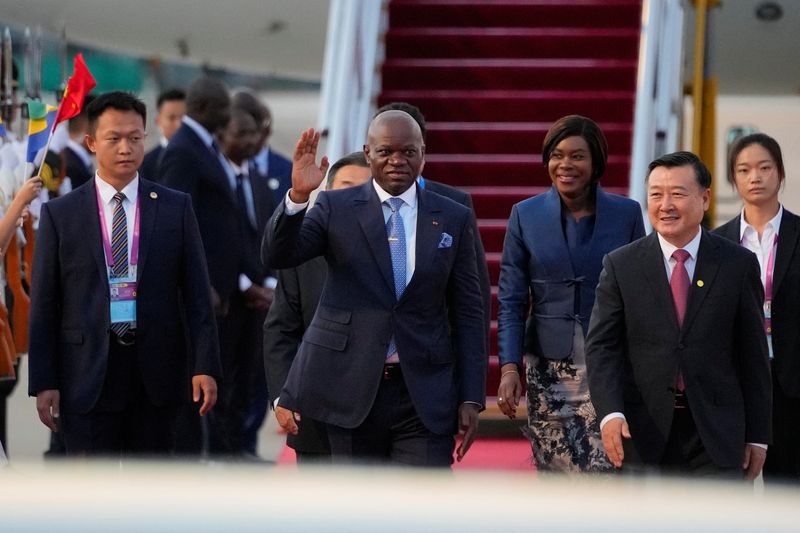

When President Xi Jinping opens the ninth Discussion board on China-Africa Co-operation Summit on Thursday, he’s anticipated to pitch plugging into China’s burgeoning inexperienced vitality business to leaders from Gambia, Kenya, Nigeria, South Africa, and Zimbabwe.

In attendance may also be delegates from each African state besides Eswatini, with which Beijing has no ties.

To keep away from dropping market share, China’s geopolitical rival, the USA, has began to host African leaders.

Britain, Italy, Russia and South Korea have additionally held Africa summits lately, recognising the potential of the area’s younger individuals and its 54 U.N. seats.

China’s outsized position as a monetary and commerce accomplice makes its conferences a far larger deal, nonetheless.

“There is no other development partner that does that much,” mentioned Hannah Ryder, founding father of Growth Reimagined, an African-owned consultancy.

“But are African leaders able to push China to really dig in so that the balance of the ‘win’ is way more towards the African side?”

MATCHING WANTS AND NEEDS

China will need to discuss up boosting commerce and entry to minerals like , cobalt and lithium in nations comparable to Botswana, Namibia, and Zimbabwe.

However it might be cautious about extra funding commitments following debt restructuring bids in economies comparable to Chad, Ethiopia, Ghana and Zambia, for the reason that 2021 summit.

“We are likely to see a continued prudence in terms of financing mega projects,” mentioned Lina Benabdallah, of the Centre for African Research at Harvard College, including that Beijing would push for expertise transfers as a substitute.

“I am most certainly keen to understand how many new finance commitments may come out of this, and how they’re going to deal with existing debt to African countries,” mentioned Yvette Babb, portfolio supervisor at asset administration agency William Blair.

However China’s enthusiasm to lend could be dampened by safety considerations, comparable to a spat between Niger and Benin that killed six Nigerien troopers guarding a PetroChina-backed pipeline, or lethal protests in Kenya over tax hikes.