By Rae Wee and Sameer Manekar

SINGAPORE (Reuters) – Asian shares edged marginally decrease on Wednesday after Federal Reserve Chair Jerome Powell supplied little hints on the timing of U.S. price cuts anticipated later this yr, whilst he signalled higher confidence that inflation was coming to heel.

MSCI’s broadest index of Asia-Pacific shares outdoors Japan eased 0.27% in early Asia commerce, shedding some steam after surging to an over two-year excessive in the beginning of the week.

In New Zealand, the rose 0.05% to $0.6128 forward of a price determination by the nation’s central financial institution later within the day, the place focus can be on any steerage for its price outlook.

Expectations are for the Reserve Financial institution of New Zealand (RBNZ) to keep up its hawkish bias on the conclusion of its financial coverage assembly, with bets for the central financial institution to chop charges simply as soon as earlier than year-end.

“I think the RBNZ should be easing sooner – a lot sooner than what they expect,” mentioned Jarrod Kerr, chief economist at Kiwibank.

“I think we’ve seen enough in the local data to expect inflation to fall back to 2%… we think they should be cutting in August but they probably will start cutting in November.”

Shares have rallied globally on the again of rising expectations of a Fed easing cycle more likely to start in September, with Powell saying on Tuesday that the U.S. is “no longer an overheated economy”.

Nonetheless, Powell offered little clues on how quickly these price cuts may come.

“He suggested that the Fed’s reaction function is shifting to an easing bias given the significantly cooling labour market, but he nonetheless declined to offer a clear timeline on rate cuts,” mentioned Alvin Tan, head of Asia FX technique at RBC Capital Markets.

“In any event, the market has been pricing in almost two full Fed rate cuts this year, and Powell’s statements didn’t shift those expectations much.”

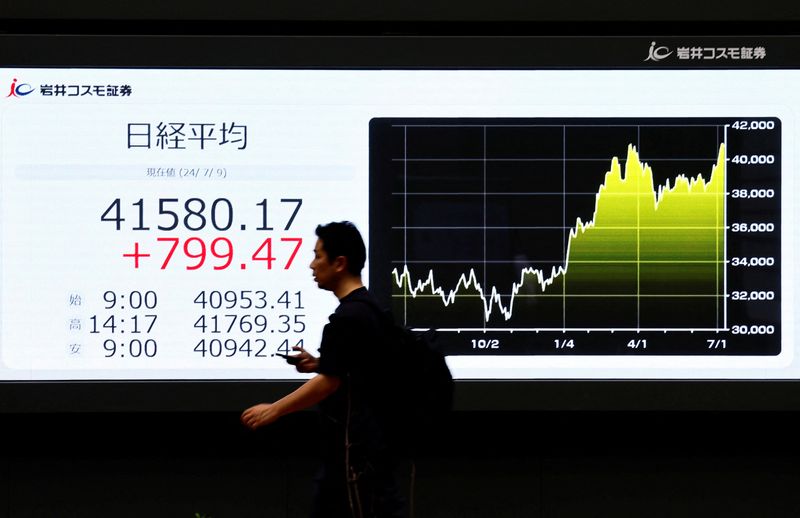

rose 0.08%, helped by a weaker yen which final stood at 161.47 per greenback.

Knowledge on Wednesday confirmed Japan’s wholesale inflation accelerated in June because the yen’s declines pushed up the price of uncooked materials imports, preserving alive market expectations for a near-term rate of interest hike by the central financial institution.

The Financial institution of Japan mentioned on Tuesday that some market gamers referred to as on the central financial institution to sluggish its bond shopping for to roughly half the present tempo underneath a scheduled tapering plan due this month.

In different currencies, the greenback held broadly regular, with sterling little modified at $1.2787 whereas the euro dipped 0.01% to $1.0813.

Oil costs rebounded following three days of declines after an business report confirmed and gas stockpiles fell final week, indicating regular demand, and because the outlook for rate of interest cuts improved. [O/R]

futures rose 0.24% to $84.86 a barrel, whereas U.S. West Texas Intermediate (WTI) crude ticked 0.29% greater to $81.65 per barrel.

Gold gained 0.07% to $2,365.09 an oz.. [GOL/]