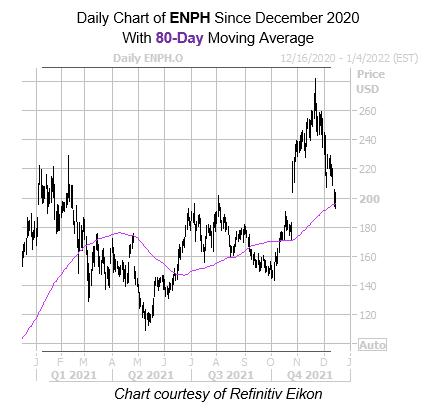

The shares of Enphase Energy (ENPH) have pulled back dramatically since surging to a Nov. 22, all-time high of $282.46. The security is now trading at its lowest level since October, though it still sports a 21.5% year-over-year lead. The good news is that the alternative energy name could make up some of these losses over the coming weeks, as its most recent drop has placed ENPH near a trendline with historically bullish implications.

Digging deeper, Enphase Energy stock just came within one standard deviation of its 80-day moving average, after some time spent above this trendline. According to data from Schaeffer’s Senior Quantitative Analyst Rocky White, similar moves have occurred six times over the past three years, with the equity enjoying a positive one-month return 67% of the time, while averaging a 13.9% pop. From its current perch of $195.68, a comparable move would put ENPH back above the $222 mark.

Refinitiv Eikon

A shift in the bearish options pits could create additional tailwinds for Enphase Energy stock. This is per ENPH’s Schaeffer’s put/call open interest ratio (SOIR) of 1.60, which sits higher than all other annual readings. In other words, short-term options traders have rarely been more put-biased.

Echoing this, the security’s 10-day put/call volume ratio of 1.39 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks in the 98th percentile of readings from the last 12 months, suggesting puts have been getting picked up at a faster-than-usual pace in the last two weeks.

What’s more, ENPH’s Schaeffer’s Volatility Scorecard (SVS) sits at 98 out of 100. This means the shares have exceeded options traders’ volatility expectations during the past year.