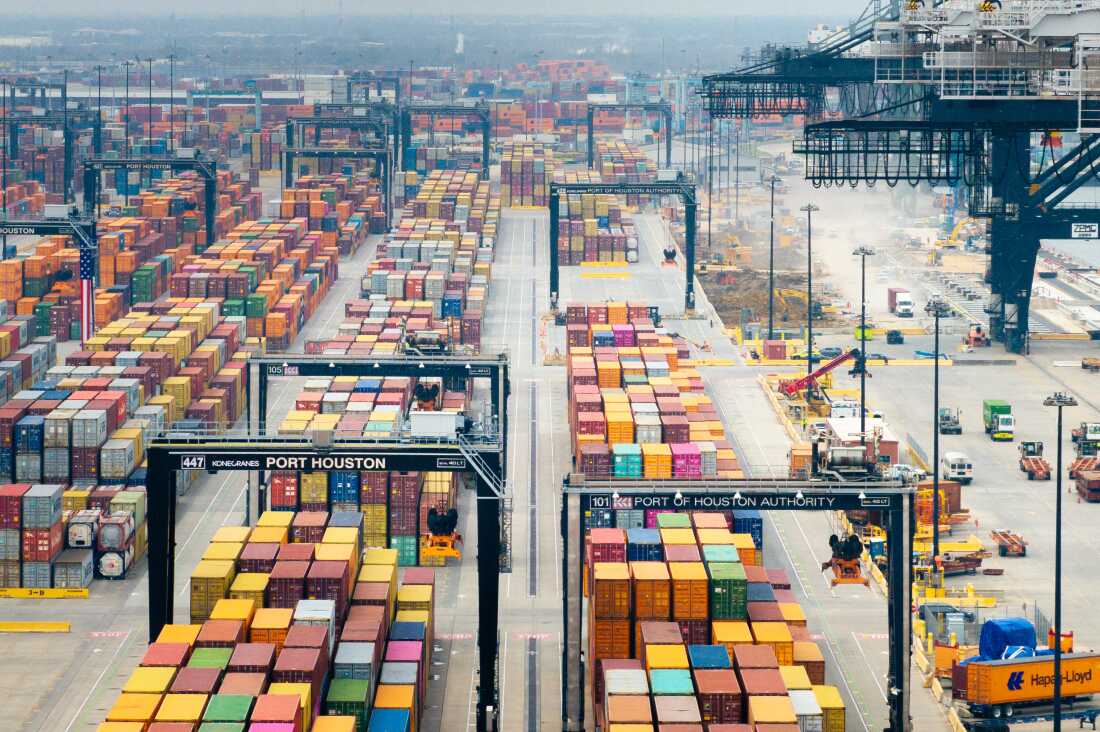

Transport containers sit on the Port of Houston in Texas final month. A raft of recent tariffs on imports from China, Canada and Mexico has firms and customers scrambling.

Brandon Bell/Getty Pictures

cover caption

toggle caption

Brandon Bell/Getty Pictures

As issues swirl over the impacts of steep new tariffs on U.S. firms and customers, so too does discuss how sure companies attempt to keep away from them.

President Trump’s long-threatened taxes on imports from China, Mexico and Canada took impact Tuesday, prompting retaliatory measures on American exports, roiling the inventory market and fueling fears of an financial downturn.

On Wednesday, Trump granted automakers a one-month reprieve from the tariffs, underscoring the unpredictability — and potential wiggle room — in his administration’s commerce coverage. On Thursday, he signed govt orders lifting tariffs on many Mexican and Canadian items till April 2.

“I’m really interested to see how much of these threatened tariffs stick, and how many of our big industries will be able to get immediate reprieves like the auto industry has already done,” says Mary Anne Madeira, an assistant professor of worldwide relations at Lehigh College. “And I’m hopeful that industries will get a lot of big carveouts and exemptions in a way that will really reduce the potential pain.”

Firms and industries have a number of major strategies to get round tariffs, from the costly means of relocating manufacturing to the extra inventive method of redesigning the merchandise themselves.

The latter is known as tariff engineering. And it explains — amongst different issues — why Converse sneakers are made partially with fuzzy material.

Whereas these methods aren’t all assured to work this time round, they provide a glimpse on the behind-the-scenes maneuvering that firms have used to deliver costs down previously.

Methodology 1: Lobbying for exemptions

One technique is to foyer the federal government for an exemption or reprieve, because the automakers did.

“The president is open to hearing about additional exemptions,” White Home press secretary Karoline Leavitt instructed reporters on Wednesday.

Firms or commerce teams can theoretically ask the Workplace of the U.S. Commerce Consultant (USTR) for exemptions from duties via what are often called Part 301 requests.

Many U.S. corporations did so in 2018 after Trump launched a main spherical of tariffs of as much as 25% on Chinese language imports. The USTR acquired requests for over 53,000 exclusions between 2018 and 2021, and granted 13% of them, based on a report by the U.S. Authorities Accountability Workplace.

The shortage of transparency round these case-by-case choices prompted some lawmakers to criticize what they noticed as USTR’s potential to “pick winners and losers,” based on the Congressional Analysis Service.

A 2024 examine discovered firms that made substantial investments in connections to Republicans earlier than and throughout the first Trump administration have been extra prone to safe tariff exemptions, whereas the reverse was true of those that contributed to Democrats.

Methodology 2: Shifting sourcing and manufacturing

Firms may additionally attempt to change the place they receive their supplies or assemble their merchandise, although that is usually simpler stated than finished.

A shopper good is normally thought-about an import when it undergoes closing meeting abroad, no matter the place the elements are from, Madeira says. So firms may at the very least theoretically shift the ultimate step of the meeting course of to the U.S.

Not less than one already has. NOBL Wheels, a Canadian producer and provider of motorcycle wheels, introduced in mid-February that it might open a brand new constructing operation and distribution middle in Bellingham, Wash., to supply “faster, hassle-free shipping that’s duty and tariff-free, with significantly shorter lead times.”

“This is an example of exactly what Trump wants to happen here,” Madeira says. “But obviously, this firm would have located assembly in the U.S. earlier than now if it was economically rational for that firm to do so, so you have to wonder if this is going to raise its costs in other areas.”

Companies may additionally think about shifting their sourcing from nations like Mexico and China to locations like Vietnam, Malaysia and Thailand, third-party nations that aren’t but part of the rising commerce conflict.

Companies should weigh the price of disrupting the availability chain towards the price of the brand new tariffs, Madeira says. And there is all the time an opportunity that the U.S. may hit these nations with tariffs down the highway.

“It’s sort of like Whac-A-Mole,” says Douglas Irwin, an economics professor at Dartmouth College. “If you hit China with a tariff, then you start importing from Vietnam, and pretty soon Vietnam will get hit with a tariff and then you import from Cambodia, or something like that. So there’s a limit to how much you can reshuffle where you’re importing from.”

Methodology 3: Reclassifying and redesigning merchandise themselves

Some firms have turned to tariff engineering as a substitute.

“In other words, companies try to say their article or their good is something that gets low tariff treatment relative to what it might actually be, in essence,” Irwin explains. “So you’re engineering your product to get into the lower tariff category.”

Typically, that may entail relabeling a product as one thing else — or at the very least making an attempt to.

Marvel efficiently argued in court docket in 2003 that X-Males motion figures are non-human toys (regardless of the premise of the franchise) fairly than dolls, practically halving their tax fee. As NPR’s Planet Money has reported, Santa fits usually tend to be deemed duty-free “festive articles” if they’ve Velcro closures — and labeled as pricier clothes if they’ve zippers.

Related arguments have ensued over whether or not a Snuggie — the outsized fleece robes with sleeves and hoods — is a blanket or a garment, which might carry completely different obligation charges. The U.S. Court docket of Worldwide Commerce formally dominated it a blanket in 2017, that means the corporate would solely need to pay an 8.5% tariff in comparison with 14.9%.

In different circumstances, tariff engineering entails making modifications to the product itself.

One instance — found in 2015 and making the rounds once more in current weeks — is that Converse All Star sneakers have a layer of fuzzy felt on the underside, permitting the shoe to be labeled as a slipper. Slippers have an obligation fee of 6%, in comparison with 20% for athletic sneakers, based on the U.S. Worldwide Commerce Fee.

Columbia Sportswear provides pockets under the waistline of sure ladies’s shirts in order that they aren’t technically labeled as blouses, which brings the obligation fee down from 26.9% to 16%, as Market reported in 2019. The corporate refers to it as a “ChapStick pocket.”

“We usually try to spin it into something that’s actually functional,” designer Becca Johnson instructed Market.

One other instance is the Ford Transit Join, a small passenger minivan generally used for bakery deliveries and building crews. Irwin explains that the tariff on vehicles is 2.5%, in comparison with 25% for vehicles — which incentivized Ford to characterize it as the previous.

Ford was accused of importing the vans from Turkey with rows of seats within the again and claiming it as a passenger car to pay the decrease tax fee.

“And then as soon as that came in, what did they do?” Irwin says. “They ripped out the seats … and just put in a flatbed, and lo and behold it’s a truck.”

The U.S. authorities ended up suing Ford for allegedly misclassifying the automobiles from 2009 to 2013 to skirt the tax. The corporate agreed to a $365 million settlement in March 2024.

Tariff engineering is authorized, versus tax evasion. U.S. Clients and Border Safety brokers are tasked with spot-checking merchandise getting into the nation and ensuring they’re labeled accurately.

“If customs accepts the reclassification or thing when it comes in, then you’re never really going to hear about it,” Irwin says.

Irwin says customs may flag merchandise that do not seem like what they’re labeled, which may result in a court docket case on the Court docket of Worldwide Commerce, a federal physique in New York. Theoretically, a competing enterprise that’s paying increased tariffs for a similar product may additionally file a swimsuit.

Tariff engineering would not apply to the brand new tariffs on Canada and Mexico, Irwin says, as a result of the charges are flat throughout all merchandise.

“If you have a tariff that’s really high in one product and lower on a very similar product, that’s when you can sort of arbitrage that difference,” he says. “But if it’s 25% regardless of whether it’s a truck or a car or a blanket or a garment, you can’t really game the system.”

Whereas firms can attempt to decrease the influence of tariffs, a lot of that burden continues to be prone to fall to particular person customers.

“Businesses have to make all the adjustments,” says Irwin. “We consumers just sort of see what’s available when we get to the stores.”