By Noel Randewich

(Reuters) – A take a look at the day forward in Asian markets by Noel Randewich.

Asia buyers will digest the close to certainty of a September loosening of U.S. financial coverage on Monday after a speech by U.S. Federal Reserve Chair Jerome Powell on Friday confirmed that america is able to start reducing rates of interest.

At his keynote speech to the Kansas Metropolis Fed’s annual financial convention in Jackson Gap, Wyoming, Powell stated “the time has come for policy to adjust,” on condition that upside dangers to inflation have diminished and draw back dangers to employment have elevated.

Powell’s feedback lifted the yen and weakened the , with decrease rates of interest relative to Japanese charges making Japan’s forex extra engaging.

Greenback/yen hit its lowest since August 6 in late Friday buying and selling.

Geopolitical danger ratcheted larger over the weekend as Hezbollah launched a whole lot of rockets and drones at Israel early on Sunday whereas Israel’s army stated it struck Lebanon with round 100 jets to thwart a bigger assault. It was one of many largest clashes in additional than 10 months of border warfare and raised the specter of Israel’s battle in Gaza turning right into a wider battle.

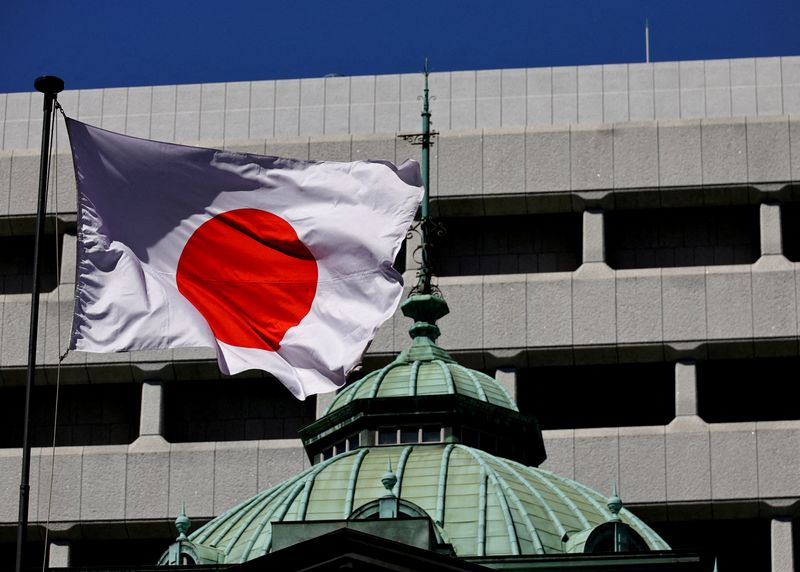

Traders can even mull the outlook for Japanese rates of interest after Financial institution of Japan Governor Kazuo Ueda on Friday reaffirmed his resolve to lift rates of interest if inflation stays on target to sustainably hit the two% goal.

Ueda’s feedback got here as information confirmed Japan’s core inflation accelerated for a 3rd straight month in July, with a slowdown in demand-driven value development probably complicating the central financial institution’s resolution on additional charge hikes.

The share common ended up 0.4% on Friday following Ueda’s parliamentary testimony.

Having spent all yr attempting to place a flooring underneath the tumbling yuan, China’s central financial institution is all of a sudden confronted with the alternative downside and is popping to delicate methods to cease the forex from appreciating sharply.

The often restrained yuan has strengthened 1.3% towards the greenback in August, lifted by expectations of Fed charge cuts strengthening Japan’s yen.

On China’s business banking entrance, Financial institution of China Vice Chairman and President Liu Jin resigned on Sunday. The state-owned lender stated its board had authorised Chairman Ge Haijiao to function performing president.

The U.S. political panorama supplied few new indicators of certainty for world buyers after Vice President Kamala Harris sealed the Democratic presidential nomination with a muscular speech on Thursday, laying down broad overseas coverage ideas and sharp contrasts with Republican rival and former President Donald Trump.

With 11 weeks left within the contest for the White Home, contracts for a Harris victory are buying and selling at 55 cents, with a possible $1 payout, on the PredictIt politics betting platform.

Contracts for a win by Trump, who has advised he would impose tariffs of 60% or larger on all Chinese language items, are at 49 cents.

Tariffs have been within the highlight final week after China’s Commerce Ministry met with automakers and trade associations to debate elevating import tariffs on large-engined gasoline automobiles, sounding a warning because the European Union nears a tariff resolution on Chinese language electrical vehicles.

On Friday, america added 105 Russian and Chinese language corporations to a commerce restriction record over their alleged help of the Russian army.

Listed here are key developments that might present extra course to Asian markets on Monday:

– Singapore Manufacturing (July)

– Japan Main Indicator (Revised) (June)