Eliminating CPI Base Effects

Since the turn of the year, markets have been fixated on possible Fed actions, seemingly ignoring signs of an imminent economic growth slowdown as they “priced-in” an aggressive Fed tightening protocol. While the yield curve, as a whole, has ratcheted upward, short-term rates spiked faster than long-term. The 2-Yr Treasury Note is now within 35 basis points (bps) (0.35 percentage points) of the 5-year and within 46 bps of the 10-year. At 12/31, these were spread 53 bps and 78 bps respectively. Remember, historically, when the yield curve has inverted (short-term rates higher than long-term), a recession has occurred 100% of the time. Because long-term rates aren’t rising as fast as short-term, the markets are telling us that they believe that Fed actions are going to slow the economy. Trouble is, the economy is already slowing!

Hysteria

Let us define “inflation hysteria.” This is the financial media’s reporting of, and emphasis on, a few biased data points, and ignoring a truly holistic view. This has caused angst in the population which has translated into the demand that the politicians (who are mostly to blame for the excess inflation in the U.S.) “do something”. They, then, have enlisted the Federal Reserve.

The markets are now reacting to their perception of the Fed’s announcements of future policy. Public statements from Fed spokespeople, like James Bullard (St. Louis Fed President and voting member of the 2022 Federal Open Market Committee (FOMC)) advocating significantly more tightening than markets had assumed after the last Fed meeting, have significantly increased both equity and fixed-income market volatility.

Base Effects

Reactions to just the headline data, without examining the entirety, can cause over-reactions. We think this is the current state of affairs.

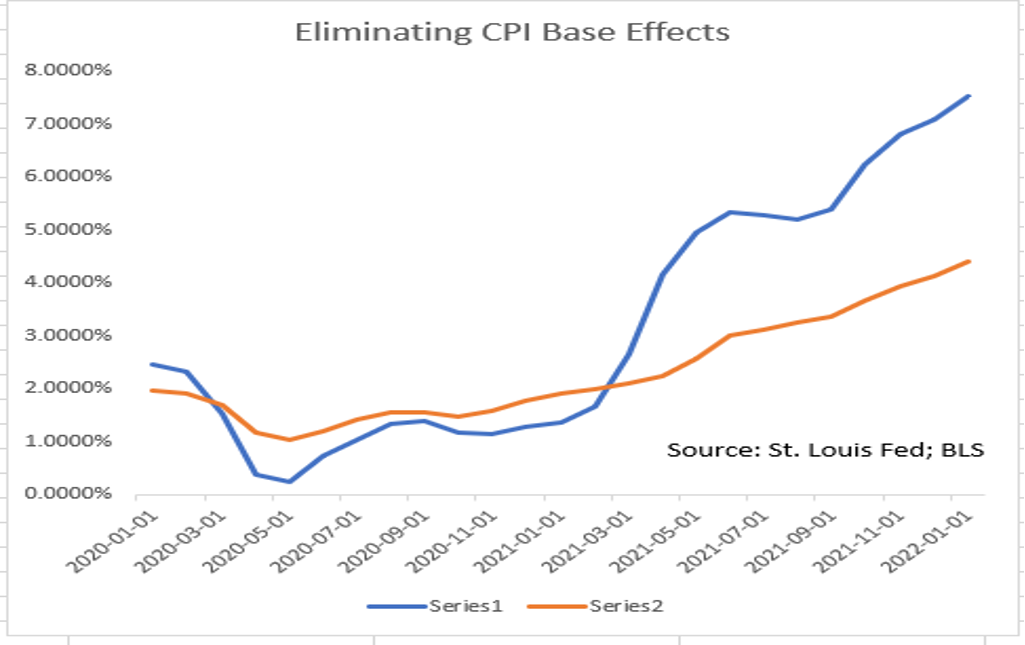

- Looking only at Y/Y data (i.e., 7.5% CPI and 9.8% PPI) ignores the “base effects.” As shown on the CPI chart at the top of this blog and the PPI chart below, the blue lines are the simple Y/Y data. Note that in these charts, the blue lines had downward slopes early in 2020, implying negative monthly data, and they only began to accelerate in 2021. In reality, we should be viewing the current inflation from the pre-pandemic era. The gold lines on the charts do just that, i.e., they calculate an annual rate of inflation using the same months two years ago as their base.

MORE FOR YOU

Eliminating PPI Base Effects

- As is evident, we have an inflation problem, but CPI of 4.4% and PPI 5.6% annual rates are nowhere near the 7.5% CPI and 9.8% PPI hysteria now in the media. This has caused heartburn in the political theater and has translated into a call for radical/extreme Fed policy action. (Note: We hope that the majority of FOMC members have cooler heads than Mr. Bullard.)

Fed Timing

As we’ve written in several recent blogs, and as is now generally echoed in the economics community, the Fed’s tools impact demand, not supply. The Fed has no ability to produce a barrel of oil or to unclog ports. A reduction in demand via Fed policy tightening in an already slowing economy risks recession, so the Fed has little room to err. And conditions for them to start tightening are troubling:

- Historically, GDP growth is robust (greater than 3%) when the Fed begins a tightening cycle. The Atlanta Fed’s GDPNow model is calling Q1 GDP growth at 1.3%.

- Tightening when the yield curve is already flat (as discussed above) risks yield curve inversion (the 100% recession relationship). So, a more aggressive Fed than what is currently “priced in” (the “Bullard Scenario”) is what is likely to invert the yield curve.

- The Fed usually begins to tighten when the stock market is rising, not when a “bear” market is a possibility.

- The Fed usually begins to tighten when consumer sentiment is strong, not when it is already in recession territory (see chart).

Consumer Sentiment

Retail Sales; Industrial Production – Not What You Think

A good example of the financial media reporting bias was January’s Retail Sales. The 3.8% January growth was a surprise to the upside for the markets, as the expectation was for 0%, or even negative. Nowhere did we see mentioned the fact that this 3.8% number was seasonally adjusted (SA), and that the not seasonally adjusted (NSA) number was a negative -18.5%! Yes, you read that right. The January 2020 NSA number was -18.2%, quite similar to the current NSA number. That January 2020 NSA number translated into a +0.6% SA result. What changed between 2020 and 2022 to inflate a +0.6% number to a +3.8% one? Answer: The pandemic!

We have written several times in this blog that the changes in behavior caused by the pandemic are not seasonal changes (i.e., absenteeism from work in January due to Omicron isn’t expected again next January). Therefore, those temporary behaviors should not be included in the seasonal adjustment process. That would logically mean that the 2019 seasonal factors should be the ones used for current data. But that isn’t the case. BLS updates each of the 12 seasonal factors every month. Thus, it is our view that the current BLS seasonal factors have been biased by “temporary” (not seasonal) behavior changes caused by the pandemic. Example: The pulling forward of 2021 holiday shopping into October/November due to the “shortages” narrative.

Additionally, the 3.8% SA January Retail Sales number should also be viewed in context of a negative -2.5% December Retail Sales number; again, not mentioned much in the financial media. So, this 3.8% number, like the employment data we discussed a couple blogs ago is a mirage.

Like Retail Sales, Industrial Production rose more than expected (1.4% M/M) in January. Looks promising! Unfortunately, only 0.2% was due to the manufacturing sector. The rest was from higher utility output due to a colder than normal winter! Was this widely reported?

Inflation Indicators Cooling

· Most of today’s inflation is coming from food, energy and autos. Food and energy are supply issues with energy also a function of politics. Autos are a function of the supply of computer chips. The three of these account for 30% of the CPI. They are up 16% Y/Y. The other 70% of the CPI is up 3.8%. Talk about inflation hysteria!

· Let’s also remember that U.S. inflation has been a supply issue with government provoking it with “free money.” Nowhere else in the developed world do we see as severe a Y/Y inflation rate as in the U.S.

- France: +3.3% Y/Y

- Japan: -1.1% Y/Y

- Norway: +3.2% Y/Y

- Switzerland: +1.6% Y/Y

- Euro Area: +5.3% Y/Y (but core: +2.3%)

· At the two major CA ports (Long Beach and LA), where a significant percentage of containers get loaded/unloaded, the number of container vessels waiting for port services has fallen from a 180 peak last fall to just north of 80 (60 is normal). (No wonder our Amazon orders are arriving the next day!)

· The business surveys are showing significant easing in inflation pressure points. For example, the most recent Philly Fed survey indicates lower Backlogs, lower Supplier Delivery Delays (see chart), lower Prices Paid (but Prices Received were slightly higher). Both Hiring and Inventory Plans were lower, and Expected Delivery Times were down significantly.

ISM Manufacturing Business Deliveries vs Backlogs

· There is plenty of evidence that part of the inflation issue is due to “price gouging.” As noted above, in the Fed surveys, Prices Received were the only inflation indicator that didn’t slow in January. This is a side-effect of the pervasive “inflation hysteria.” Because the public now expects higher prices, it is easy for companies to raise them. No justification needed. No one will object!

· The Consumer’s Expected Inflation Rate (see chart), peaked in October (4.2%) and has fallen back to 3.5%. Inflation can’t become endemic without buy in from the public.

Consumer Expected Inflation Rate (3-Year Median)

· The chart below shows multi-family units under construction. This is a 5-decade high (highest since July, 1974). Rents are a 30% weight in the CPI. These units will enter the market this spring and summer, and they will have a big and negative impact on rental inflation.

5+ Unit Housing Under Construction (Thousands SAAR)

Other Data

The following indicators directly show slowing sectors:

- The chart below shows that wages are not keeping up. It is the Atlanta Fed’s Wage tracker less the CPI. Consumers are falling behind. Don’t expect the magic of seasonal adjustment to cover the coming consumptions slowdown for much longer!

Atlanta Fed Wage Growth Tracker Median Wage Growth

- January’s Housing Starts were weak (-4.1% M/M), especially the single-family category. Such starts were down -5.6% M/M in January on top of -3.3% in December. Y/Y, single family starts are off -2.4%. (Could it be high prices and rising mortgage rates?) As noted above, multi-family starts are at record levels (+8.3% Y/Y). (Could it be rising rents?)

- Hand-in-hand with weak single-family housing starts are falling mortgage purchase applications, down nearly -11% over the two weeks ended February 11. No doubt this is due to rising mortgage rates which are based on the 10-Year Treasury yield. As discussed at the top of this blog, the 10-Year Treasury yield has spiked up, and we suspect this will continue to put upward pressure on mortgage rates which will further slow the housing sector.

- In the ISM Manufacturing PMI, 66.7% of those surveyed reported higher inventories, the highest for any January and third highest for any month on record. Remember that inventory growth was responsible for more than 70% of Q4’s GDP growth. It appears that for Q1 and beyond, inventory growth will be neutral to negative, almost guaranteeing several soft GDP growth quarters.

Final Thoughts

There is no denying that inflation is an issue in today’s economy. However, using a more appropriate base from which to measure indicates that it isn’t as severe as the financial media portrays. In addition, the data, properly viewed, show a reduction in inflationary pressures in the works along with much slower future economic growth.

Nevertheless, the media’s inflation hysteria has riled up the masses and caused concern in the political realm which has now been transferred to the Fed to solve. Markets have reacted by pushing up interest rates and causing consternation (volatility) in the equity pits. The Fed called an emergency meeting after Bullard’s comments caused rates to spike even higher last week. We will know this week, via the press statement released after the meeting, if the FOMC majority has turned more hawkish (a la Bullard) or if the “data dependent” moderate approach prevails. If the former, rates are likely to spike higher and the yield curve may invert (recession very likely). From our point of view, only if the doves prevail will there be the possibility of a soft landing for the economy.

(Joshua Barone contributed to this blog)